Are You issuing Unbalanced check? Proceedings under the Banking Offenses Act

Nov Mon 2020 06:23:01

1309 views

Kathmandu. If you are paying someone by check, first check the balance in your bank account. Please check only after the account has been cleared.

Nepal Rastra Bank (NRB) has made an arrangement to punish you under the Banking Misconduct Act 2064 BS if you return the check after withdrawing the check. If the recipient of the check fails to withdraw the money even after going to the check bank three times in a row, action will be taken under the Banking Misconduct Act 2064.

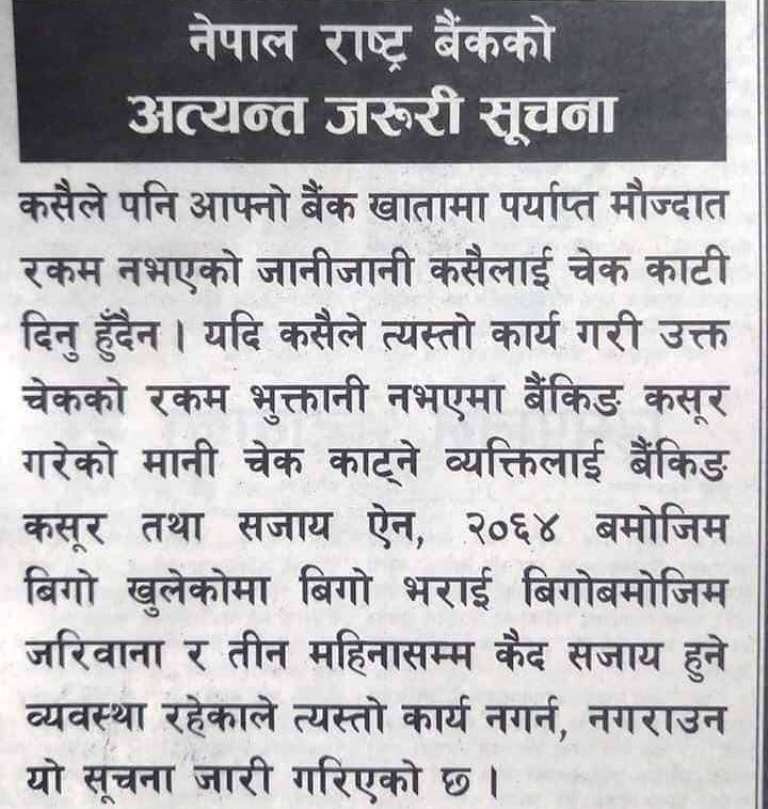

No one should deliberately cut off a check if they do not have sufficient balance in their bank account. In case of non-payment of the check, the person who deducts the check is found to be guilty of banking offense. The bank said in a statement.

If someone has given you a check for an account without money, you should go to the police and lodge a complaint. Police take bounce check complaints seriously. And, the person issuing the check is arrested by the police.

Not only that, there is money in the account but the check bounces even if it is not exchanged by the bank due to unsigned signature. So before cutting the chalk, pay special attention to whether the signature matches or not.

A person who bounces the same check up to three times can be punished up to opening a bank account and taking a loan in the future. Not only that, under the Banking Offenses Act, you have to go to jail.