25 commercial banks refund the premium interest taken against the rules from loan customers by NRB Instructions

Dec Tue 2022 02:48:33

1012 views

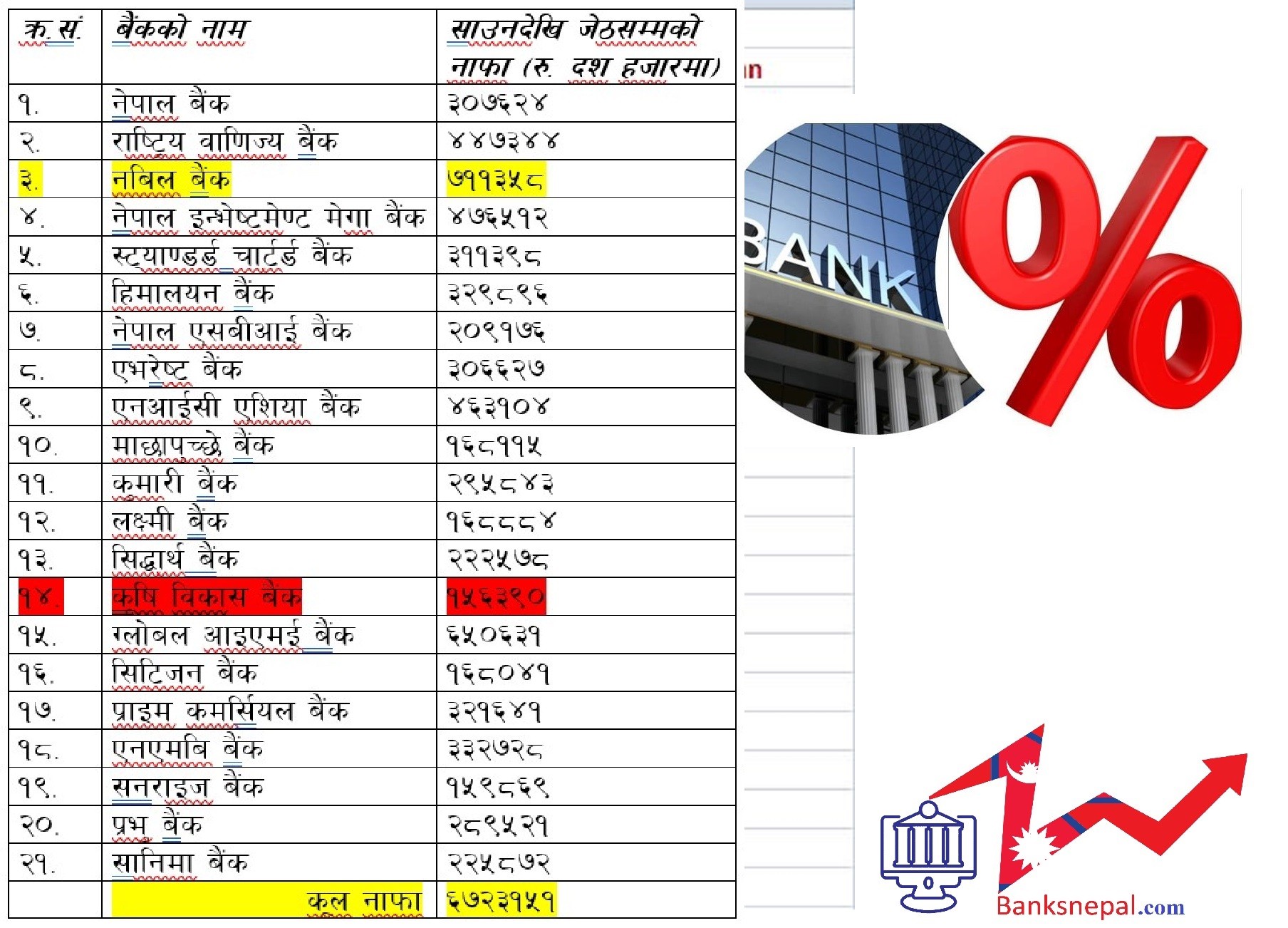

Kathmandu. Banks have returned more than 4.5 billion rupees of interest collected by increasing premiums illegally. Sources of Nepal Rastra Bank have said that 25 commercial banks have returned the interest charged by raising the premium from a minimum of 40 million rupees to 48 million rupees.

According to Rashtra Bank sources, 25 banks were instructed to return the interest charged illegally by increasing the premium in the last financial year.

According to the Central Bank, only 25 banks, which received preliminary approval for the financial statements of the financial year 2078/79, have illegally increased the premium by 4.66 billion rupees and charged interest. Rashtra Bank officials say that they have given preliminary approval to the financial statement on the condition of returning the said amount and most of the banks are matching the amount to be returned or the interest to be charged.

Nepal Rastra Bank has linked the loan interest rate with the base rate. The interest rate of the loan is determined by agreement between the borrower and the bank as to how much percentage premium will be charged on the base rate.

Based on the base rate of the banks, the loan badger decreases. But the loan cannot be made lower than the agreement on how much premium to take. Banks have to calculate the average base rate on a quarterly basis and only if there is a decrease in the base rate, the interest rate of the loan will also decrease accordingly.

The interest rate of the loan is determined by adding a certain percentage premium agreed upon between the borrower and the bank, taking the base interest rate as the reference interest rate. "The premium rate to be added to the base rate should be clearly mentioned when determining the interest rate of loans and mortgages to be provided to a person or firm," Nepal Rastra Bank has said in the integrated instruction issued for banks and financial institutions in 2078.

At the beginning, the bank and the borrower agree on the premium to be added to the base rate, after disbursing the loan, the premium cannot be changed throughout the duration of the loan. "Once the premium rate is determined and mentioned in the loan proposal letter given to the borrower, after the loan is granted, it is not allowed to increase the premium rate or implement a plan such as automatically increasing the premium rate again by providing some kind of discount," it is stated in the integrated directive 2078.

The base interest rate is the rate that includes the elements of determining the interest rate of the loan that can be clearly identified and applied equally to borrowers who avail loans from banks and financial institutions. The base rate is not the actual interest rate of the loan, it is only the basis for determining the interest rate. Base rate is calculated by including cost of deposit or cost of funds, operating cost of the institution (percentage), required cash balance (percentage), statutory liquidity ratio (percentage) and return on assets (percentage).

However, in the last financial year, after finding that the banks had increased the premiums and collected more interest from the borrowers contrary to the instructions, the National Bank has instructed to refund the interest. When the banks sent the annual financial statements for approval, the National Bank did not approve them until the interest was returned, so the banks were forced to return the interest.