Kathmandu. As of the of August 2023, commercial banks in Nepal are providing 9.99% in FDs. Previously, it was 12.133% in annual interest on fixed deposits as of 1st January 2023. In the coming August, banks will provide maximum interest rate up to 10.896 percent for individuals. On the institutional side, 8.896 percent interest will be given. .

Now Commercial banks have established new interest rates. Banks have determined the interest rate to be maintained for the month of August. Compared to July, some banks have reduced the interest rate, while some banks have increased it. However, some banks have continued the interest rate of July.

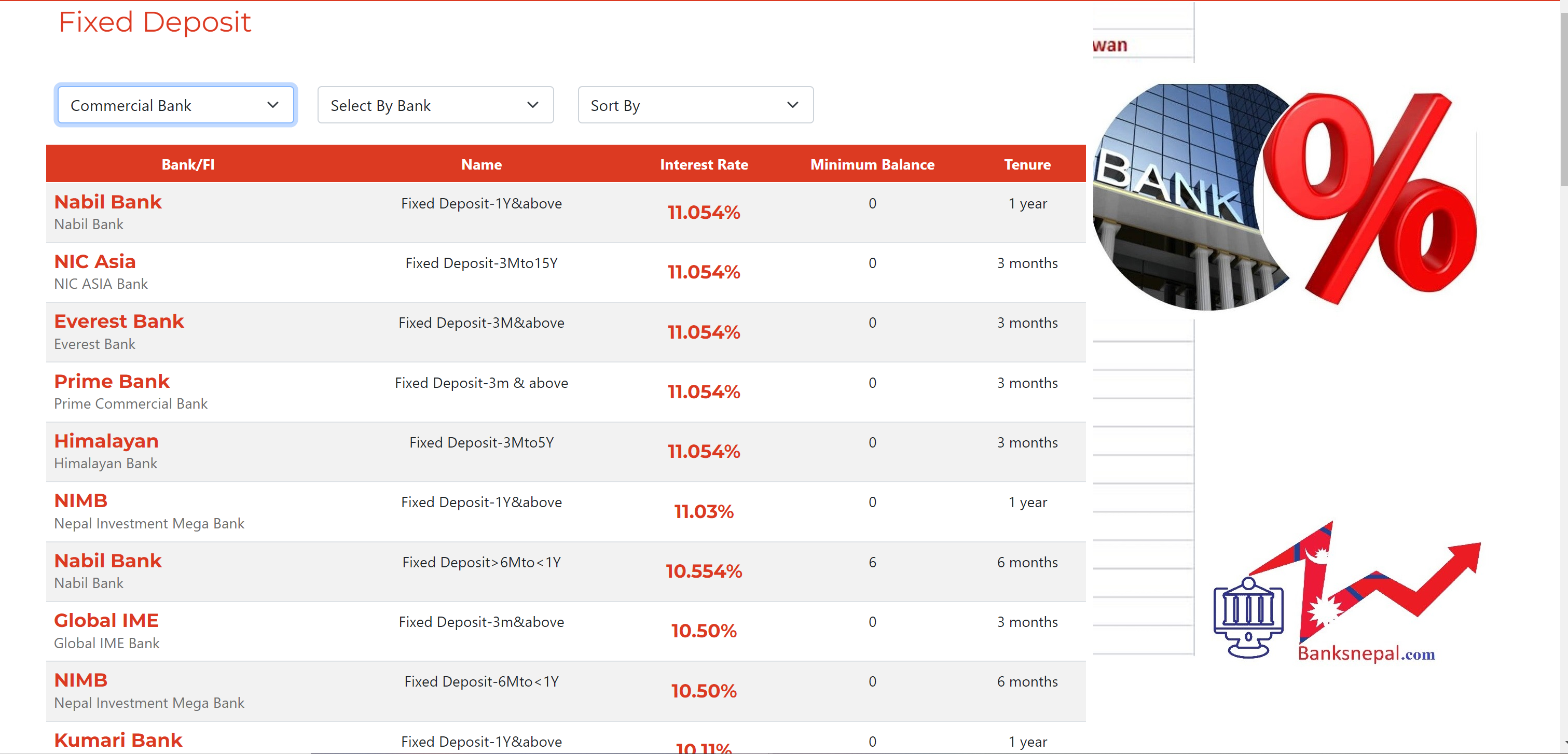

Commercial banks have recently announced their updated interest rate profiles for the month of Ashwin . Most commercial banks are offering an annual interest rate of approximately 5% for depositors who maintain savings accounts during Ashwin. Meanwhile, individual customers have the opportunity to earn a maximum interest rate of 11.36% per annum on fixed deposits (FDs), whereas institutions can secure an interest rate of 9.36% per annum on their fixed deposits.

It is worth noting that, SCB has chosen to reduce its rates, offering the lowest rates among all 20 commercial banks, with a 5.29% interest rate for institutional FDs and a 7.79% interest rate for individual FDs. In contrast, the standard savings rate at SCB remains at 5.9%. In a comparative analysis, Nepal SBI Bank has set its institutional FD rate at 6.2%, while the individual FD rate stands at 8.2%.

Prime Commercial Bank Limited (PCBL) boasts the highest FD rates among all commercial banks, offering an institutional FD rate of 9.36% and an individual FD rate of 11.36%. However, PCBL's regular savings account provides a yield of 6.36%-8.36% which is again higher than that of any other commercial bank.

Furthermore, Everest Bank Limited and Himalayan Bank Limited have slightly elevated interest rates for their institutional and individual FDs, with rates of 9.05% and 11.05%, respectively. Concurrently, both banks maintain general savings rates at 6.05%. Similarly, in simpler terms, Nepal Rastra Bank mandates that banks cannot change their savings and fixed deposit interest rates by more than 10% compared to the rates they published in the previous month.