Why Stock market crashes in India and Investor attraction into China market ?

Oct Sun 2024 03:24:49

589 views

Kathmandu: The BSE Sensex index of the Indian stock market has fallen by more than 4,000 points. According to 'India Today', which has reduced the assets of investors by 16 lakh crores of Indian rupees. The reasons for this sharp decline include global factors.

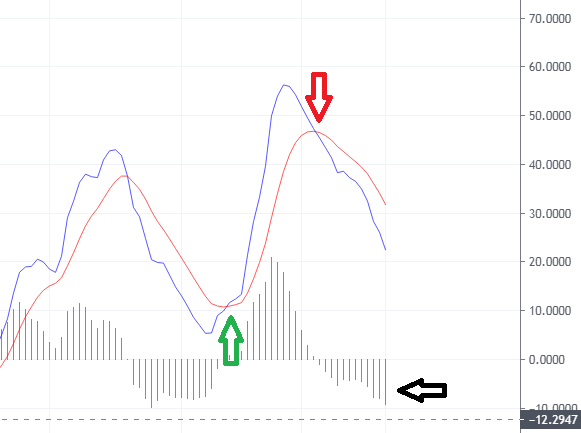

Due to the Iran-Israel conflict, China's stimulus policy, there has been a large sale in the stocks of various sectors. Last Friday, the index dropped by 808 points to 81,688 points. Nifty 50 also fell by 235 points to 25 thousand points. In the last 5 trading days after September 27, the Sensex has fallen by 4,148 points.

The combined market capitalization of companies listed on the Bombay Stock Exchange has fallen to Rs 461.26 lakh crore. This week Sensex and Nifty recorded their worst period since June 2022. The Sensex fell by 4.3 percent while the Nifty 50 fell by 4.5 percent.

Investor concerns grew after Iran launched ballistic missiles at Israel earlier in the week, raising fears that an escalation could disrupt oil supplies from the region. Oil prices ticked higher on the day. A rise in oil prices is a negative for importers of the commodity like India, as crude contributes significantly to the country's import bill.

China's recent economic stimulus has made investors focus on the Chinese market. Chinese stocks were trading at cheaper prices than Indian stocks. Because of this, foreign institutional investors transferred their capital. The 'CSI 300' index, which measures China's bluechip companies, rose by 8.48 percent on September 30.

Due to the conflict between Iran and Israel, investors' sentiments have further weakened. Iran fired about 200 missiles at Israel. Which has increased the concern of long-term conflict in this region. This widespread decline has affected many sectors. However, IT stocks are said to be somewhat safe due to improved sentiment following the US Federal Reserve's monetary policy reforms.