Category/business-economy (Total Articles : 104 )

Commercial banks bad loans has Increased

Kathmandu. It has been seen that there has been a huge increase in the bad loans of the commercial banks that have gone through the merger. This was seen in the unrefined financial statements of the second quarter of the current financial year released by...

Read More

Infodevelopers 'CAN In-Fotech-2023' has started at Bhrikutimandap Kathmandu

Kathmandu. The exhibition 'Infodevelopers Can Infotech-2023' has started from today at Bhrikutimandap. Communication and Information Technology Minister Rekha Sharma inaugurated the exhibition.The exhibition organized with the aim of providing information about various products and services in the field of information...

Read More

97 billion 10 million in surplus but Current account deficit of more than 29 billion

Kathmandu. As of the end of January of the current financial year, the balance sheet is in surplus by Rs. 97 billion and 10 million. This is seen in the current economic and financial situation of the country published by Nepal Rastra Bank.

Read More

The preparation of the new budget has started- the capacity and needs of the government will be taken : Bishnu Poudel (finance minister)

Kathmandu. Deputy Prime Minister and Finance Minister Bishnu Prasad Paudel has said that while bringing the budget for the next financial year and spending the budget for the remaining period of the current year, the government will proceed by looking at the capacity and needs...

Read More

Internet banking with ATM, wallet charges reduced : Now mobile banking through up to 3 lakh transactions per day

Kathmandu. Nepal Rastra Bank has reduced ATM fees. The bank has reduced the inter-bank ATM, wallet and internet banking fees by issuing the integrated directive on payment system, 2079. The National Bank has reduced the fees charged for withdrawing money using wallet, internet and card...

Read More

Trade loss exceeded 7 billion: Imports decreased by 20 percent and exports decreased by 32 percent

Kathmandu. In the 6 months of the current fiscal year 2079/80, the trade deficit is more than 7 billion. This is shown by the statistics published by the Customs Department up to the end of January of the current year.During...

Read More

Rs. 43 billion deposits added in banking system of Nepal

Kathmandu.Deposits of 43 billion rupees have been added to the banking system within a week. According to Nepal Rastra Bank, as of January 3, the total deposits of banks and financial institutions are 53 trillion 54 billion rupees. The total deposit was 53 trillion 11...

Read More

25 microfinances declare dividend and 7 microfinances AGM completed

Kathmandu. Banks and financial institutions are announcing dividends in a hurry. Financial companies have announced the distribution of dividends to their shareholders from the profits of the last financial year 2078/79.So far, most of the banks have declared dividends and distributed...

Read More

NEPSE Up 2200 points soon : Only Selling Pressure market not increase even the bank's interest rate confirm to decrease

Kathmandu . Since the arrival of the new government, the stock market's enthusiasm has increased, and since then, the turnover has been continuously decreasing. Although the interest rate is certain to decrease from January, the stock market continued to decline on Thursday.

Read More

Foreign exchange reserves increased by 6 percent to 12 trillion 92 billion, sufficient for 9 months of imports

Kathmandu. Foreign exchange reserves have reached about 13 trillion. In the five months of the current fiscal year 2079/80, the foreign reserves have reached 12 trillion 92 billion 56 million rupees.Foreign reserves increased by 6.3 percent compared to the end...

Read More

Nepalese economic indicators are becoming positive : Remittance increased by 23 percent

Kathmandu. There are signs of improvement in the Nepalese economy. Recently, the economic indicators are becoming positive. Some indicators of the country's economy have become positive due to restrictions and restrictions on imports.The statistics of the current economic situation of...

Read More

Nepal's economic growth rate is 5.1 percent 2022/2023 - The World Bank

Kathmandu. It has been announced that the economic growth rate of Nepal will be 5.1 percent in the fiscal year 2022/023 and 4.9 percent in 2023/024.The World Bank released its Global Economic Prospects report on Tuesday. According to the World...

Read More

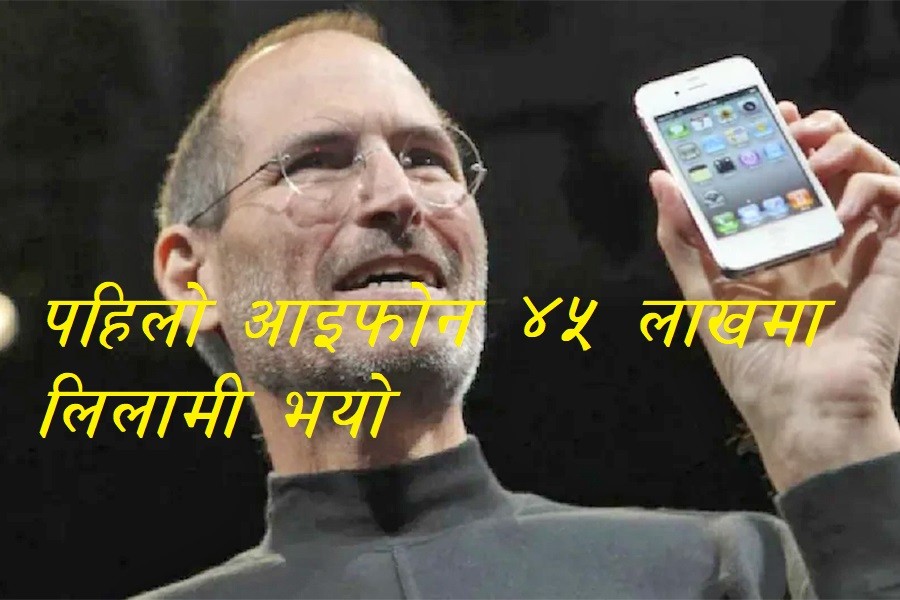

The first iPhone was sold on 45 lakhs

Kathmandu. The iPhone One has been auctioned in America. An unopened, unused iPhone One was auctioned for 35,414 US dollars, which is about 45 lakh rupees. Similarly, the first iPod, which was launched in 2001, has been sold for 25,000 dollars, i.e. about 32 lakhs....

Read More

Sign of Economic Crisis in Australia

Kathmandu. There are signs of an economic recession in Australia. The real estate business has decreased, while the loan to income ratio has increased by 187.2 percent, increasing the risk.For the first time since the economic recession of 1991, Australia...

Read More