Category/exclusive-news (Total Articles : 2499 )

Top 6 commercial banks of Nepal under pressure from primary capital funds

Kathmandu. Nepal Rastra Bank also set the growth rate of loans to the private sector at 11.5 percent through the monetary policy of the current fiscal year 2080/81. Before that, the banks which were aggressively expanding their business got a bit hesitant after that policy...

Read More

Which bank has the highest salary scale in Government banks and private banks of Nepal

Kathmandu. Government banks are becoming more efficient in providing salary to employees. According to the latest data published by the National Bank, employees working in government-owned banks have enjoyed more service facilities than commercial banks run by the private sector. According to the data released...

Read More

IFC's $56 million loan to Global IME Bank

Kathmandu. The International Finance Corporation (IFC), a member of the World Bank Group, has signed an agreement to invest 56 million US dollars in Global IME Bank Ltd. This investment will be mobilized to increase financial access to small and medium enterprises, including businesses run...

Read More

Top 10 highest salary scale of Nepali CEOs : Nepali banker CEOs salary over 4.5 million per CEO

Kathmandu. Here, We have collected the data of several banks CEO’s Salary. Banks CEO are the focal personalities of Nepal. It is the most prestigious as well as challenging positions. Salary of CEOs of Commercial Banks of NepalMany people are...

Read More

Jhyamolong Hydro to issue shares

Kathmandu. The Hydropower Development Company is going to issue an IPO in Jhyamolong, which is constructing the 32 MW Karuva Seti Hydropower Project. For which Lakshmi Sunrise (LS) Capital has been appointed as the share issue and sales manager.The company...

Read More

Interest on loans fall by 11 percent and interest on treasury bills by 69 percent

Kathmandu. In the 6 months of the current financial year, bank interest has decreased. According to the data published by Nepal Rastra Bank, the weighted average interest rate of 91-day treasury bills for 6 months of the current year was 10.89 percent, while it was...

Read More

Nepal Rastra Bank Report: Banks interest rates and Inflation falling down, now the economy is improving

Kathmandu. Nepal Rastra Bank has conveyed the message that the economy is heading in the right direction. Recently, while there have been various debates, discussions and concerns about the problems in the economy, the National Bank has said that the economy is on the right...

Read More

Top 10 banks of Nepal NPL Report : 8 banks to pay dividends to shareholders by Q2 nd Report of 2080/081

Kathmandu.Top 8 banks potential NPL report out of the 20 banks in operation published their financial statements including the ability to pay dividends to shareholders. According to the financial statements of 6 months of the current year, the distributable profit of only Standard Chartered, Nabil,...

Read More

Share market trends in Nepal: Nepse up trend but increasing selling pressure to be fall by 2050 points

Kathmandu. Last week, shares were bought and sold on four days in the Nepal Stock Exchange (NEPSE). In the first two days, the market index increased by 86.16 points, while the last two days decreased by 19.34 points. There has been a significant improvement in...

Read More

Nabil Bank's profit decreased by 6.38 percent in Q2 Report

Kathmandu. In the second quarter of the current financial year, the profit of Nabil Bank has decreased by 6.38 percent. According to the financial situation of the second quarter announced by the bank, the profit of the bank has decreased by 6.38 percent to 3.20...

Read More

The NEPSE index declined by 31 points and the top most traded Himalayan Reinsurance company

Kathmandu. On the second day of trading of the week (Monday), the Nepal Stock Exchange (NEPSE) index fell by double digits. The market, which decreased by 25.63 points on Sunday, also decreased by 31.49 points to close at 2098 points on Monday.

Read More

How much dividends of Insurance companies of Nepal 2079/080 ?

Kathmandu. Insurance companies have declared dividends for the financial year 2079/080. 6 insurance companies have paid dividends. Out of which 4 are non-life insurance companies and 2 are life insurance companies. So far, Citizen Life Insurance, Reliable Nepal Life, Nepal Insurance, Himalayan Everest Insurance, NLG...

Read More

Nepal's bad loan has reached 24 billion, 85 billion with in 6 months

Kathmandu. In the 6 months of the current financial year, the total public debt of Nepal has reached 23 trillion 84 billion 48 billion rupees. Out of this, the internal debt is equal to 11 trillion 98 billion four crore 22 million and the external...

Read More

Top 10 bank's profit has declined in Nepal

Kathmandu. In the second quarter of the current financial year 2080/81, the net profit of banks has decreased. Banks' profit decreased by 10 percent in the middle of January due to bad loan growth and interest income of banks.Banks have...

Read More

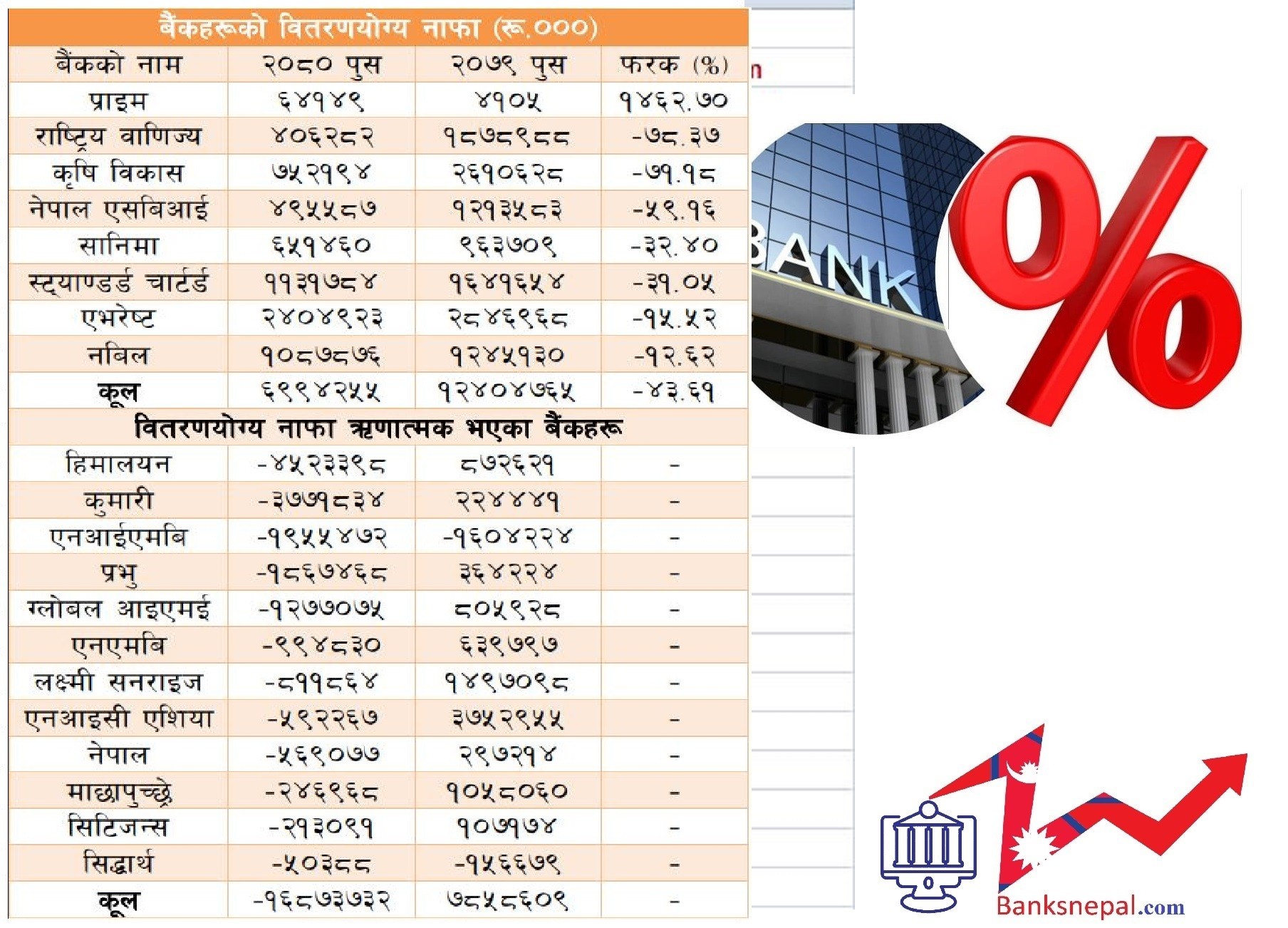

Top 12 commercial banks of Nepal distributable profit is negative

Kathmandu. In the second quarter of the current financial year 2080/81, the distributable profit of most of the commercial banks is negative. According to the data released by the banks, the distributable profit of 12 commercial banks is negative and 7 banks have decreased till...

Read More