Nepal Life Insurance is leading top first of life insurance company of Nepal, See the other life insurance company financial status

Nov Fri 2020 07:53:12

4121 views

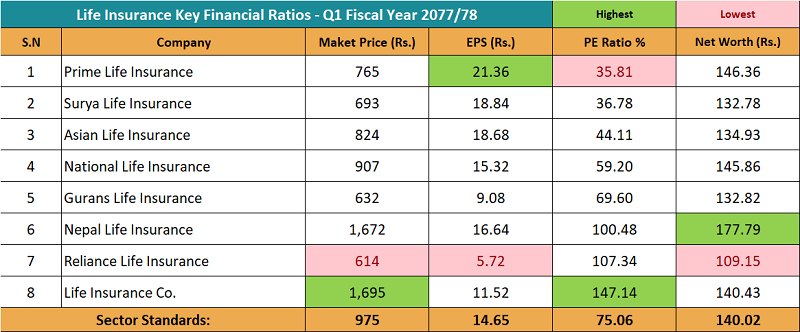

Nepal Life has maintained its lead among the life insurance companies till the first quarter of the current fiscal year. Among those active in the life insurance sector and listed on the stock market, Nepal Life is far ahead while other life insurance companies are following Nepal life.

The main source of insurance business of Nepal Life, which has the highest paid-up capital of Rs 5.49 billion, is in the forefront of indicators including net premium income, profit, life insurance fund and reserve fund.

Reliance Life Insurance has increased its own premium by 91.98 percent till mid-October of the current fiscal year. Reliance's paid-up capital has reached Rs 2.10 billion after the IPO.

After Nepal Life, National Life has a paid up capital of Rs 3.8 billion. Similarly, Prime, Surya, Reliance Life, Asian Life and Life Insurance Corporation Nepal have raised a minimum paid-up capital of more than Rs 2 billion.

Similarly, the paid up capital of Gurans Life Insurance is at least Rs 1.97 billion.

The eight life insurance companies listed in Nepse have earned a net profit of Rs 794.5 million in the first quarter of the current fiscal year. Among them, Nepal Life Insurance has been earning the most net profit. Nepal Life has earned a net profit of Rs 229 million during the period.

After that, Prime Life Insurance paid Rs 127 million, National Life Rs 118.3 million, Surya Life Rs 101.6 million, Asian Life Rs 97 million, LIC Nepal Rs 57.9 million, Gurans Life Rs 42.7 million and Reliance the least. Life has earned a net profit of Rs 30 million.

Nepal Life has also accumulated the largest amount in reserves and life insurance funds. Nepal Life has a reserve fund of Rs 3.66 billion and a life insurance fund of Rs 94.82 billion.

Similarly, National Life has a life insurance fund of Rs 35.94 billion and a reserve fund of Rs 1.14 billion.

Reliance Life has a reserve fund of Rs 173 million and a life insurance fund of Rs 1.39 billion.