How much liquidity in the bank : Nepal Rastra Bank pulled out 13 trillion 27 billion liquidity from banks of Nepal

Jun Sat 2024 09:18:10

576 views

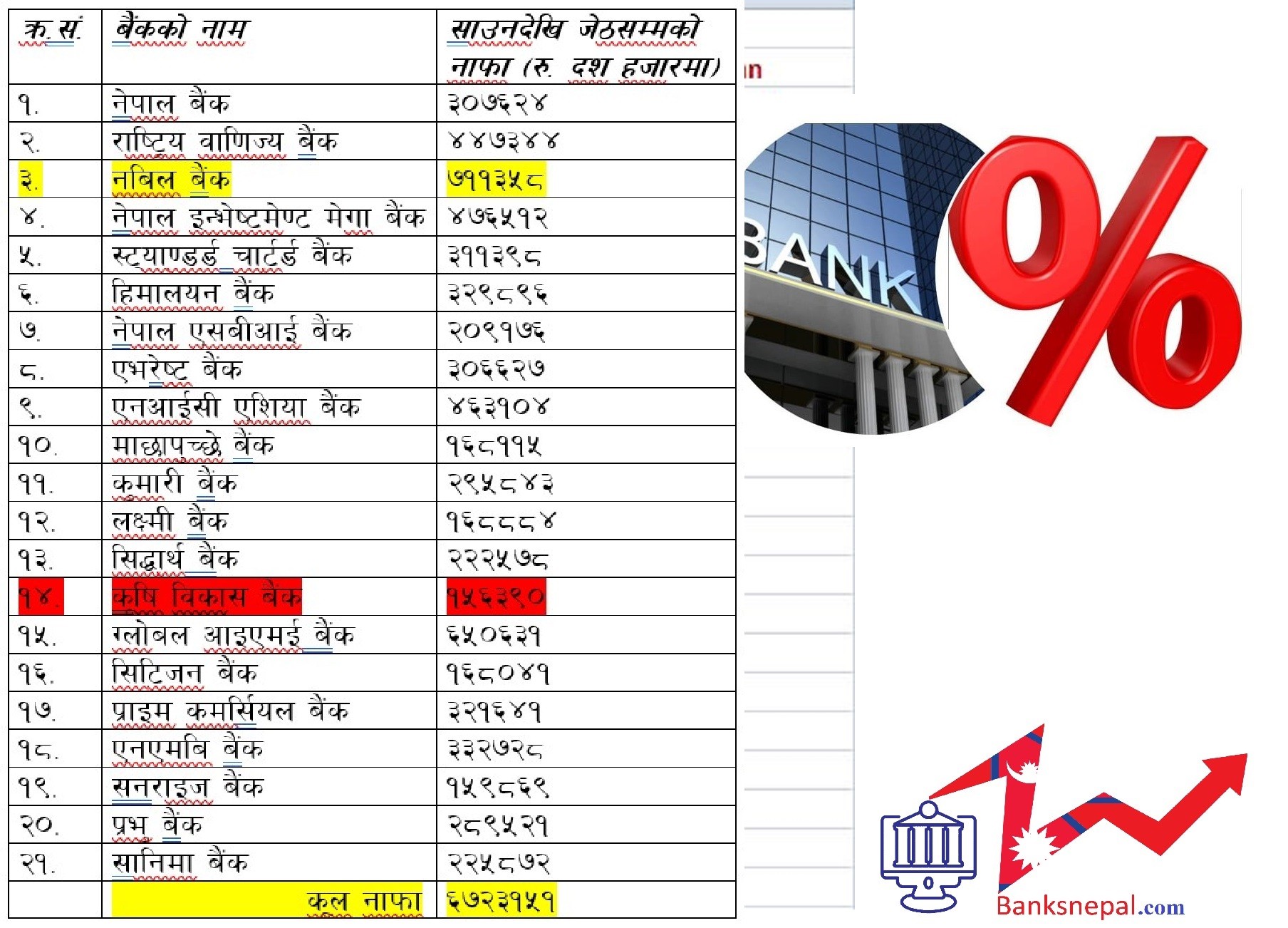

Kathmandu: Nepal Rastra Bank (NRB), Central Bank of Nepal has been widely criticized due to lack of liquidity in the past years, has been forced to manage it due to excess liquidity in the current financial year. Currently, banks and financial institutions have more than 6 trillion rupees of liquidity.

The central bank (NRB), which sent trillions of rupees to the market after the lack of liquidity in the last financial year, has pulled out trillion money from the market in the current financial year 2080/081 to excess liquidity. Now the central bank has been forced to liquidity manage in banking and financial institutions of Nepal.

To manage liquidity, the central bank has been repeatedly using deposit collection tools and fixed deposit facilities. Through these 2 tools, the central bank has collected net 13 trillion 27 billion 33 crore rupees from the market in 10 months of the current financial year

By the end of April 2024, the central bank has withdrawn 7 trillion 44 billion 20 crore rupees from the market through deposit collection tools. Similarly, 13 trillion 87 billion 85 crore rupees have been withdrawn from the market by using the permanent deposit facility.

The data shows that the Central Bank has withdrawn a total of Rs 21 trillion 32 billion 5 crore deposits in 10 months but has sent Rs 8 trillion 4 billion 71 crore to the market. 8 trillion 3.51 billion rupees have been sent to the market through Overnight Facility (OLF). Similarly, it is mentioned in the central bank's data that 1 billion 20 million was sent under permanent liquidity facility.

Based on this, the net liquidity calculation in the 10 months of the current financial year is 13 trillion 27 billion 33 billion rupees. In order to manage excess liquidity, the Central Banker had implemented the permanent deposit facility since February 2080.

Similarly, the National Bank has now concluded that the permanent deposit facility has become ineffective and has said that it will review this arrangement. The central bank is preparing to review this facility through the monetary policy of the next financial year.

Liquidity is continuously being drawn through deposit collection instruments as the fixed deposit facility is ineffective. The National Bank has been using various tools to effectively implement the interest rate corridor. Due to excess liquidity, even though the deposit collection rate has gone below the lower limit of the inter-bank interest rate corridor, the National Bank is continuously drawing liquidity.