How Much distributable dividend of Development banks ? Muktinath and Mahalaxmi Bank can give highly dividen

Aug Wed 2021 11:12:15

3345 views

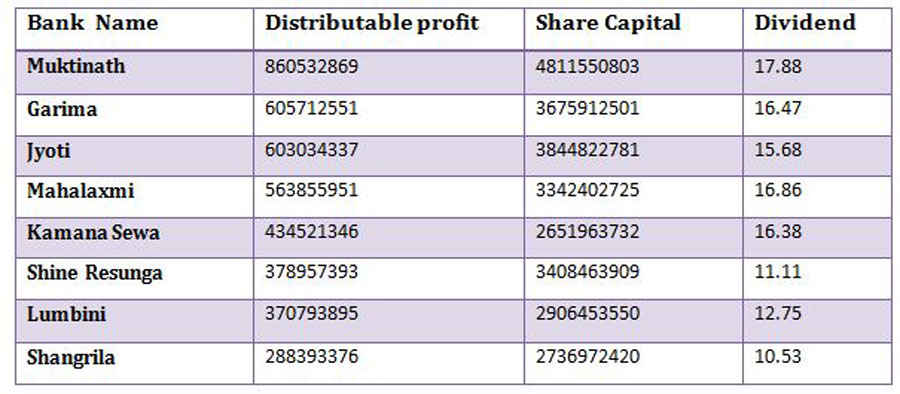

Kathmandu. Eight national level development banks are facing stiff competition. According to the financial statements of the fourth quarter of the last fiscal year 2077/78, the competition of all the eight development banks has increased. The average dividend capacity of all the eight development banks is 14.71 percent.

Muktinath Development Bank is at the forefront of dividend distribution. Muktinath Development Bank's dividend capacity is 17.88 percent. As per the financial statement of the fourth quarter of the last fiscal year, the total distributable profit of Muktinath Development Bank is Rs. 865 million while the paid up capital of the bank is Rs. 4.81 billion. Based on this, the total dividend capacity of Muktinath Development Bank is 17.88 percent. Similarly, Garima Development Bank is seen as a development bank that pays more dividends. Garima Development Bank has a distributable profit of Rs 600 million and a paid up capital of Rs 3.67 billion. Based on this, the dividend potential of the bank is 16.47 percent.

Mahalakshmi Development Bank is the third highest dividend paying bank. The bank has a distributable profit of Rs 560 million and a paid up capital of Rs 3.34 billion. Based on this, the dividend potential of the bank is 16.86 percent.

Similarly, the dividend potential of Kamana Seva Bank is 16.38 percent. Jyoti Development Bank also has a total distributable profit of Rs 600 million and a paid up capital of Rs 3.84 billion. Based on this, the bank has the capacity to pay 15.68 percent dividend.