Kathmandu. Mutual funds have significantly increased dividend distribution. The company has significantly increased its dividend distribution compared to the previous fiscal year.

Currently, 18 mutual funds have declared dividends in the closed and open mutual funds. Collective investment funds have increased their total dividend capacity by 291.49 percent in the last fiscal year as compared to the previous fiscal year.

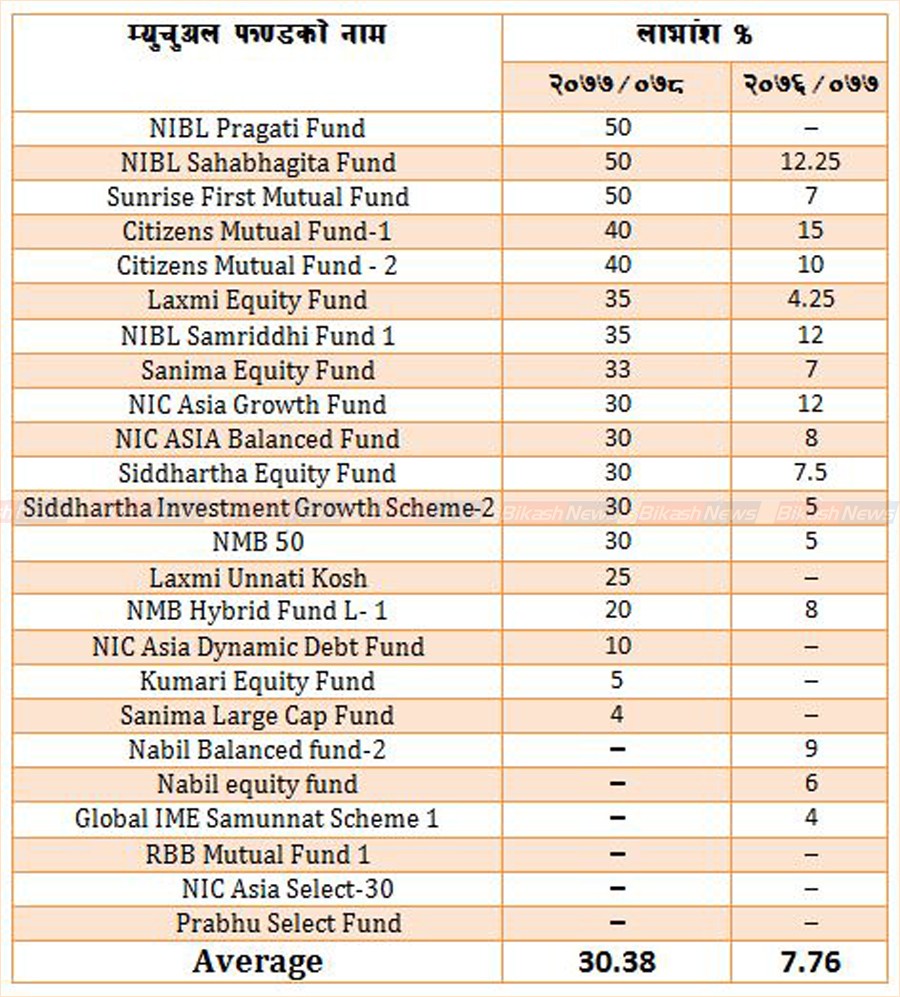

In the previous fiscal year, 16 companies had paid an average dividend of only 7.76 percent, while in the last fiscal year, 18 companies have an average dividend potential of 30.38 percent. Which is 291.49 percent more than the previous fiscal year. Collective investment funds only distribute cash dividends to investors.

NIBL Pragati Fund, NIBL Participation Fund and Sunrise First Mutual Fund are the collective investment funds that have paid the highest dividend in the last fiscal year. All three have already declared 50 percent dividend.

Similarly, Citizens Mutual Fund-1 and Citizens Mutual Fund-2 have declared 40 percent dividend while Laxmi Equity Fund and NIBL Prosperity Fund-1 have declared 35 percent dividend. Sanima Equity Fund has declared a dividend of 33 percent, NIC Asia Growth Fund 30 percent, NMB-50 30 percent and Siddhartha Investment Growth Scheme-2 30 percent.

NIC Asia Dynamic Fund has declared a dividend of 10 percent, Kumari Equity Fund 5 percent and Sanima Large Cap Fund 4 percent. Other companies are at a loss. The company has not declared a dividend.