Kathmandu. Bank receives the interest due by mid-August 2078, it will be able to account for the amount in mid-July 2078, and the distributable profit of the banks will increase.

According to the unrevised financial statements made public by commercial banks, the average dividend potential of commercial banks is 14.5 percent.

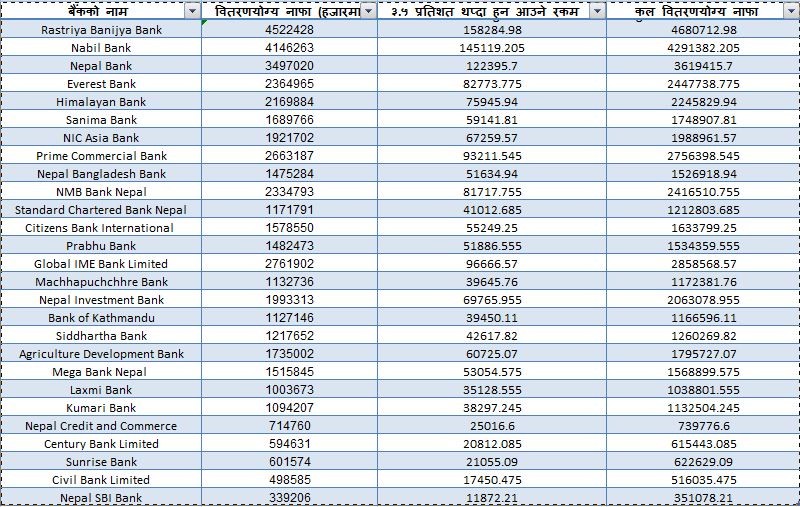

According to bankers, the banks' interest recovery is expected to be between a minimum of 2 percent and a maximum of 5 percent during this period. The average recovery interest for a minimum of 2 percent and a maximum of 5 percent is 3.5 percent.

According to the financial statement of the last fiscal year made public by Rastriya Banijya Bank, the distributable profit of the bank is Rs. 4.52 billion. If Rastriya Banijya Bank's 3.5 percent increase in total distributable profit increases, the bank's distributable profit will increase by Rs. 158.2 million during this period to a total of Rs. 4.68 billion. In this regard, the dividend potential of the bank will also increase.

Similarly, Nabil Bank is also seen as a bank with higher distributable profit. The total distributable profit of Nabil Bank is Rs. 4.14 billion. If Nabil Bank grows 3.5 percent during the period, its distributable profit will increase by Rs 145.1 million to Rs 4.29 billion.