NRB New Instructions to Banks and Financial Institutions on Foreign Exchange: Easier inflow of foreign loans and remittances

Aug Wed 2022 02:06:55

1288 views

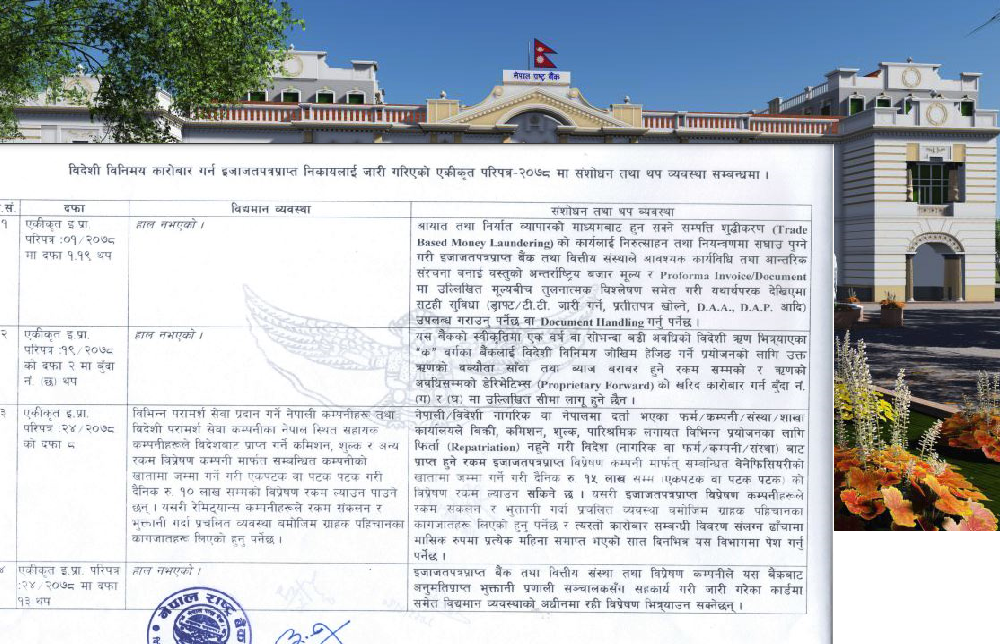

Kathmandu. Nepal Rastra Bank has issued various additional instructions for the implementation of the monetary policy for the current financial year. Rastra Bank has amended the Integrated Circular 2078 while implementing the monetary policy 2079/80. Rastra Bank issued a unified directive for banks and financial institutions on Monday and made more new provisions.

Integrated Circular 2078 issued to licensed entities for foreign exchange transactions has been amended/added and instructions have been issued to A category commercial banks, B category development banks and licensed entities.

According to the new regulations, the licensed banks and financial institutions have created necessary procedures and internal structures to help discourage and control the activities of trade-based money laundering, which can be done through import and export trade. If it is found to be realistic after conducting a comparative analysis between the prices mentioned in the document, it has been arranged to issue the same facility (draft/TT, opening of receipt).

Similarly, for the purpose of hedging the foreign exchange risk, the ``A'' category banks, which have entered into a foreign loan of one year or more with the approval of the National Bank, can purchase derivatives (Property Forward) up to the amount equal to the outstanding principal and interest of the said loan and up to the term of the loan. It is also said that the limit mentioned in (c) and (d) is not applicable.

Rastra Bank licensed foreign nationals of Nepal or firms/companies/organizations/branch offices registered in Nepal for various purposes including sales, commissions, fees, wages, etc., without repatriation. Daily Rs. Arrangements have also been made to bring one-time or one-time remittances up to 15 lakhs. Earlier, there was only provision up to 10 lakh rupees.

Licensed banks and financial institutions and remittance companies can also enter remittances subject to the existing arrangements on cards issued in collaboration with the payment system operator licensed by the National Bank.