Global IME Bank aggressive in business expansion followed by Nabil, NIMB, Kumari, Prabhu and Himalayan Bank

Mar Thu 2023 03:17:52

799 views

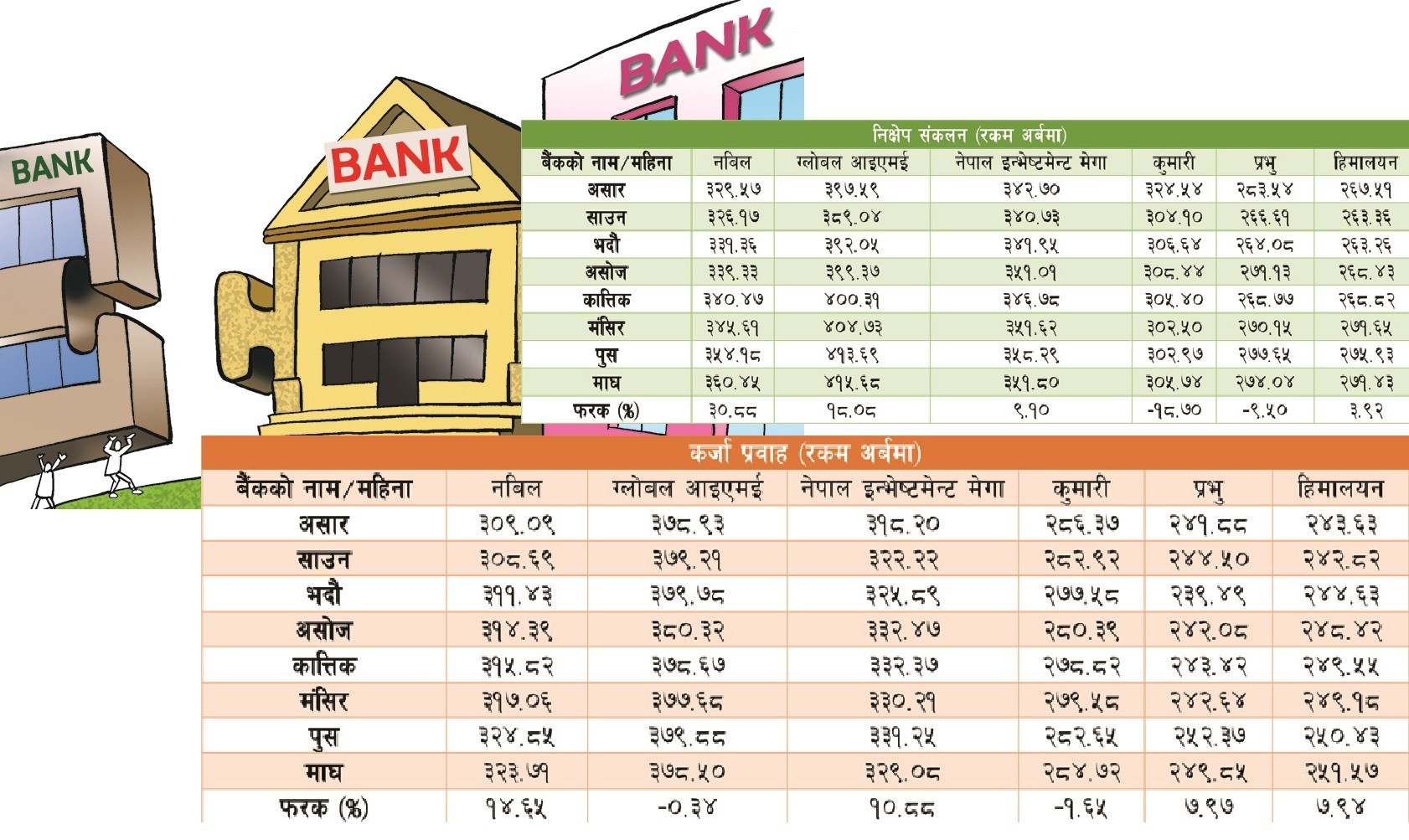

Kathmandu. Recently, Interesting competition in business expansion between the commercial banks that have gone after big merger. Nabil Bank, Global IME Bank, Nepal Investment Mega Bank (NIMB), Kumari Bank, Prabhu Bank and Himalayan Bank, which have joined the merger, have an interesting competition in business expansion.

Statistics of the Nepal Bankers Association have shown that there is an interesting competition between these banks that have gone to merger to become the number one in deposit collection and loan expansion. In the 7 months of the current financial year, commercial banks have collected deposits of 47 trillion 41 billion rupees and extended loans of 42 trillion 90 billion rupees.

By the end of January, these 6 banks have collected deposits of 19 trillion 79 billion rupees and disbursed loans of 18 trillion 17 billion 43 billion rupees. Among the currently operating banks, the share of these 6 banks in deposit collection and loan disbursement is high.

Global IME Bank has collected the most deposits. The bank has brought in more than 18 billion deposits in a period of 7 months. Which belongs to the bank that collects the most deposits in the banking sector. According to the statistics up to January, bank deposits have reached 4 trillion 15 billion rupees. Till the end of last June, the bank had deposits of 3 trillion 97 billion 59 crore rupees.

Similarly, Nabil Bank increased its deposits by 30.88 billion rupees in 7 months to 3.60 billion rupees. By the end of last June, the bank had collected 3 trillion 29 billion rupees in deposits.

Similarly, Nepal Investment Mega Bank has collected 3 trillion 51 billion rupees by increasing deposits by 9 billion rupees. Last June, the bank had deposits of 3 trillion 42 billion rupees. Similarly, Himalayan Bank has raised 3.92 billion rupees to 2.71 billion rupees till January. As of last June, the bank had deposits of 2 trillion 76 billion rupees.

In the period of 7 months, the deposit collection of 2 banks has decreased. Deposits of Kumari Bank decreased by 18 billion rupees to 3 trillion 5 billion rupees and deposits of Prabhu Bank decreased by 9 billion rupees to 2 trillion 74 billion rupees. Last June, deposits with Kumari Bank were 4 trillion 24 billion rupees and with Prabhu Bank 2 trillion 83 billion rupees.

Global IME Bank will be aggressive in credit expansion. Statistics show that the bank has disbursed loans of Rs 3.78 billion 50 crore till January. Last June, the bank gave a loan of 3 trillion 78 billion 93 crore rupees. Although the bank provided the highest amount of loans, in the period of 7 months, the loan amount decreased by 34 million rupees.

Similarly, Nabil Bank has provided loans of 3 trillion 23 billion rupees by increasing 14 billion rupees. By the end of last June, the bank had disbursed 3 trillion 9 billion loans.

Similarly, Nepal Investment Bank has extended loans of 3 trillion 29 billion rupees by increasing 10 billion rupees. Earlier, last June, the bank had disbursed a loan of 3 trillion 18 billion rupees.

Similarly, Kumari Bank's loan has decreased by Rs 1 billion. The bank had disbursed 2 trillion 84 billion rupees till January. By the end of last June, the bank had disbursed 2 trillion 86 billion rupees.

Similarly, Prabhu Bank increased its loan from 7.97 billion rupees to 2.49 billion rupees and Himalayan Bank increased its loan from 7.94 billion rupees to 2.51 billion rupees. Until last June, Prabhu Bank had provided loans of 2 trillion 41 billion rupees and Himalayan Bank 2 trillion 43 billion rupees.