Kathmandu. The amount set aside by commercial banks for possible risk management (loan loss provision) due to liabilities has increased. The amount allocated by the banks for this purpose has reached nearly one and a half billion. The data provided by Nepal Rastra Bank up to the end of May of last financial year 2079/80 shows this.

During the period of 11 months, banks have set aside 1 trillion 42 billion 41 crore 22 lakh rupees for possible risk management. June is 72.23 percent or 59 billion 72 crore 84 lakh rupees more than the previous fiscal year 2078/79 till the end of May. In the previous year, banks had set aside 82 billion 683 million rupees for such arrangements.

Especially, the impact of the recent global economic recession on the Nepalese economy has also weakened the consumer market and the production of business, industry and factories has decreased. Its effect has also been seen in the bank's investment. Since there is no production and market, the borrowers have not even been able to use the bank's interest payments (installments). Because of this, the rate of bad loans of banks has increased.

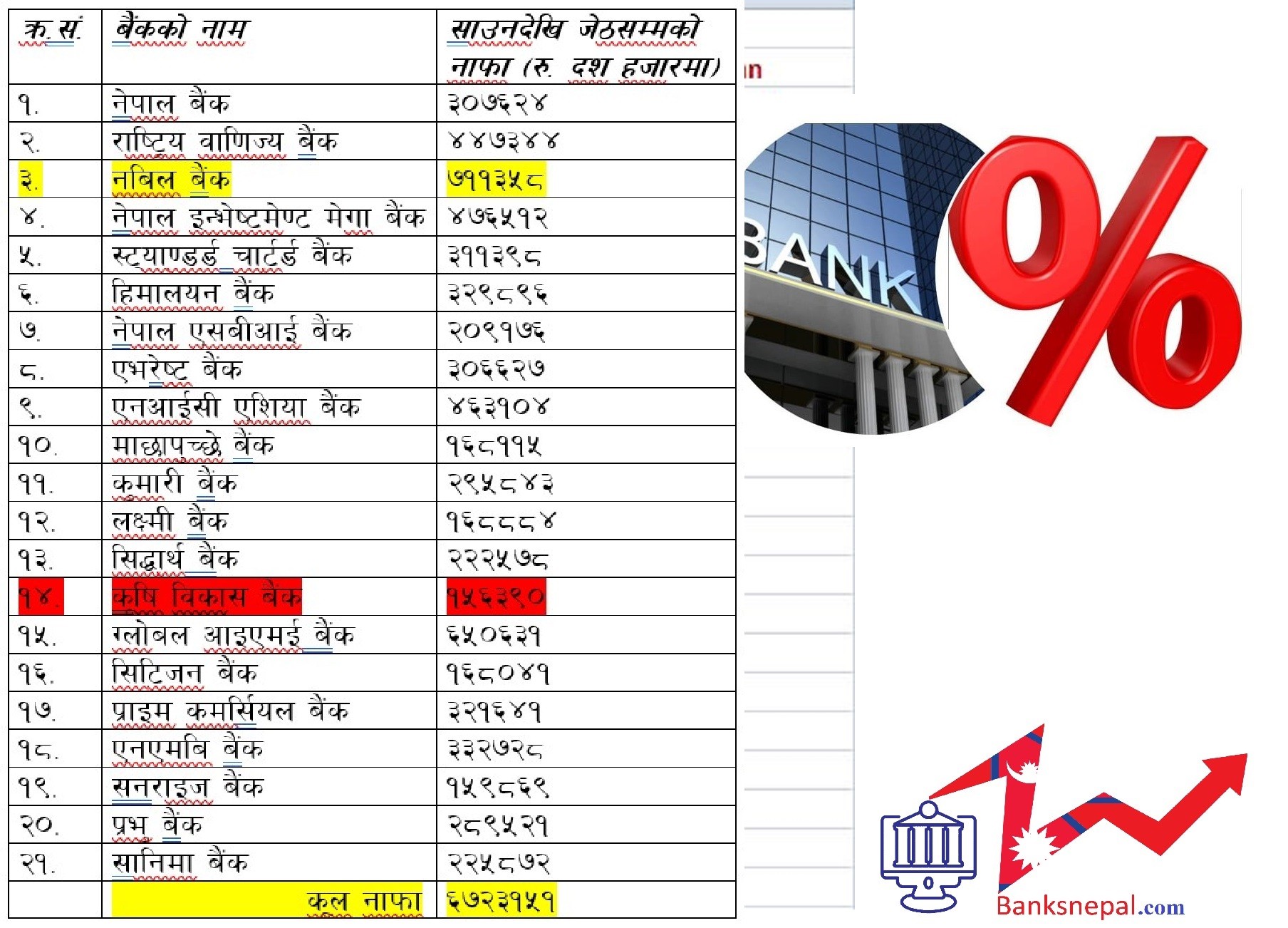

Due to the economic recession, the loans and investments provided by the banks are not being recovered. Bankers say that due to these reasons, the amount allocated for possible risk arrangements has increased. For this reason, most of the banks that have gone to the merger have allocated the amount. According to the statistics of the National Bank, the highest number of Global IME Banks has been observed. Global IME Bank has set aside 13 billion 83 billion 75 lakh rupees for possible risk arrangements. Compared to the previous year, this amount of the bank has increased by 100 percent.

Nepal Investment Mega Bank has also set aside 12 billion 95 million 41 million rupees for possible risk management. Similarly, Kumari Bank has allocated 11.81 billion 50 million rupees, Nabil 11.13 billion 75 million rupees and Himalayan Bank has allocated 10.7 billion 83 million rupees.

Similarly, the government-owned National Commercial Bank has also allocated 9 billion 365 million rupees. Similarly, Prabhu Bank has set aside 8.74 billion rupees, 7.45 billion rupees by Krishi Bikas Bank, 6.22 billion rupees and 8.7 billion rupees by Nepal Bank for possible risk arrangements.

Likewise, Siddharth Bank 5.95 billion 36 million, NMB Bank 5.888 billion 86 million, Prime Bank 5.49 billion 84 million, NIC Asia 5.31 billion 93 million, Citizen Bank 4.68 billion 35 million, Savik's Sunrise Bank 4.17 billion 1.2 million, Savik Lakshmi Bank 3.9 billion 98 million, Sanima 3.46 billion 5 million rupees for possible risk management.

Machhapuchhre Bank 3.375 million rupees, Nepal SVI 3.29 million 1.3 million rupees, Everest Bank 2.95 million 3.5 million rupees and Standard Chartered Bank 2.29 million 1.6 million rupees have been set aside for possible risk management.