Category/exclusive-news (Total Articles : 2499 )

Nabil Bank opening 36 new branches soon

Kathmandu. Nabil Bank is aggressively expanding its branches. Nabil, which recently merged with Nepal Bangladesh Bank, is going to expand its branches in all seven provinces of the country. The bank has searched for houses to operate branch offices in 36 different commercial and market...

Read More

SEE Result Is Going To Be Released Today : Results Can Be Viewed on SMS and Online

Kathmandu. The National Examination Board is going to announce the results of this year's Secondary Education Examination (SEE) at 3 pm today.Controller of Examinations Arjun Rayamazhi informed that all preparations have been completed to announce the result of SEE. "In the...

Read More

The implementation of some provisions in the monetary policy is challenging: CBIFIN

Kathmandu. Nepal Rastra Bank has released the monetary policy for the financial year 2079/80. According to the Bank and Financial Confederation, the monetary policy has adopted timely policies to bring the declining economy back to the rhythm.The confederation has announced...

Read More

State Bank of India launched WhatsApp banking Service

Kathmandu. State Bank of India (SBI) has launched WhatsApp banking service for its Savings State Bank of India has launched WhatsApp banking service for its savings bank and credit card customers.SBI customers can now check their account balance and mini...

Read More

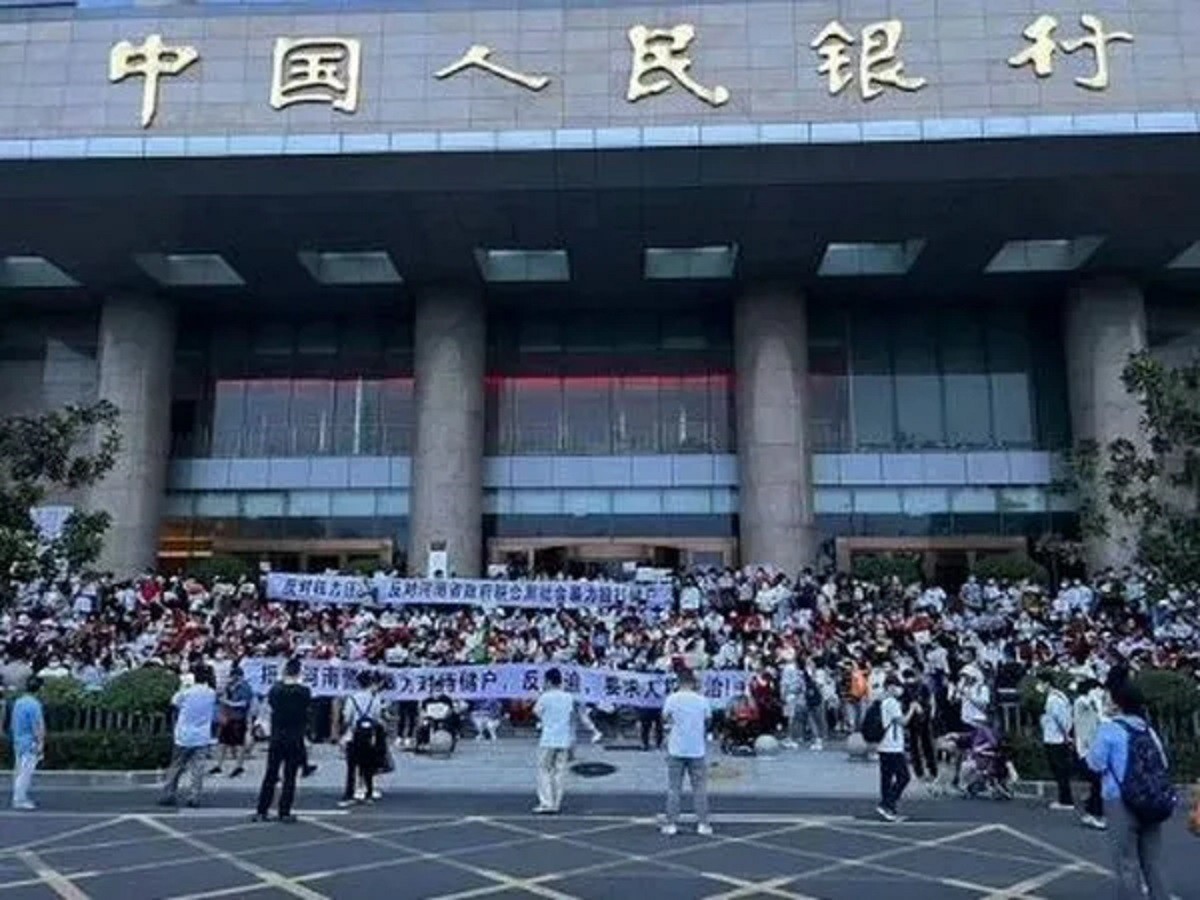

Financial crisis in China : Banks are collapsed, customers were banned from going to the bank and accounts were frozen

Kathmandu. A major banking crisis has occurred in China. The situation is so bad that many banks have banned their customers from withdrawing money. In this situation, thousands of people have been demonstrating on the streets since April. Demonstrations have turned violent in many places....

Read More

Excel Development Bank passed 8.95 percent dividend

Kathmandu. The 16th Annual General Meeting of Excel Development Bank Limited has been completed. The bank held its annual general meeting under the chairmanship of Mahendra Kumar Goyal, chairman of the board of directors, on Monday.The meeting will distribute bonus...

Read More

Siddharth Bank honored by 'Best Annual Financial Report 2021' Award

Kathmandu. Siddharth Bank has been honored with the 'Best Annual Financial Report 2021' award in the banking sector. The Nepal Chartered Accountants Association has given the award to the bank for financial transparency, accountability and good governance of the organization based on the annual report...

Read More

Sanima Bank started 'Video KYC' Service

Kathmandu. Sanima Bank has started 'Video KYC' service for its customers. Non-residents and people from Nepali countries can open an online account from abroad and perform 'Video KYC' to update their account.Customers are freed from the hassle of coming to...

Read More

Jyoti Bikas Bank launched 'Video Banking' Services

Kathmandu. Jyoti Bikas Bank celebrated its 14th anniversary of establishment on Monday 9th of Shravan. The bank celebrated its anniversary at the central office in Kamalpokhri in the presence of members of the board of directors, former directors, employees and customers.

Read More

Market Inflation to 14 percent with in 3 month : Nepal Rastra Bank

Kathmandu. Nepal Rastra Bank has said that the price increase will reach 14 percent in three months. The National Bank is releasing a survey and said that the price increase rate will reach 14 percent in the next three months. Also, the National Bank has...

Read More

"Red signal" in deposit collection of commercial banks of Nepal

Kathmandu. The beginning of the first month of the current financial year has been bad for commercial banks. In the first 6 days of this year, a 'red signal' has been seen in the deposit collection of commercial banks. According to the data of Nepal...

Read More

Monkey Pox outbreak : Health emergency Declared by World Health Organization (WHO)

Kathmandu. The World Health Organization (WHO) has declared monkeypox as a public health emergency. In the meeting of the International Health Regulation Emergency Committee held on July 7 to review the multinational outbreak, the director general of the organization, Dr. Tedros Adhanom Ghebreyesus, declared monkeypox...

Read More

How much distributable profit of 8 commercial banks of Nepal

Kathmandu. 8 commercial banks have published the unrefined financial statements up to the last quarter of the last financial year. 8 commercial banks including Citizens Bank, NIC Asia Bank, Prabhu Bank, Laxmi Bank, Sunrise Bank have released their financial statements.Citizens...

Read More

6 Commercial Banks are Final Merger Process

Kathmandu. In recent times, commercial banks have started to merge rapidly. So far, 6 different banks have already signed preliminary agreements for the merger. Nepal Investment (NIBL) and Mega Bank, Global IME and Bank of Kathmandu (BOK) and Himalayan Bank and Civil Bank have signed...

Read More

The Social Security Fund will provide loans up to 75 lakhs at low interest rates

Kathmandu. Now the investors of social security fund will get loans from the fund. With the approval of the Ministry of Labour, Employment and Social Security, the way to get a loan has been opened.It is said that the guidelines...

Read More