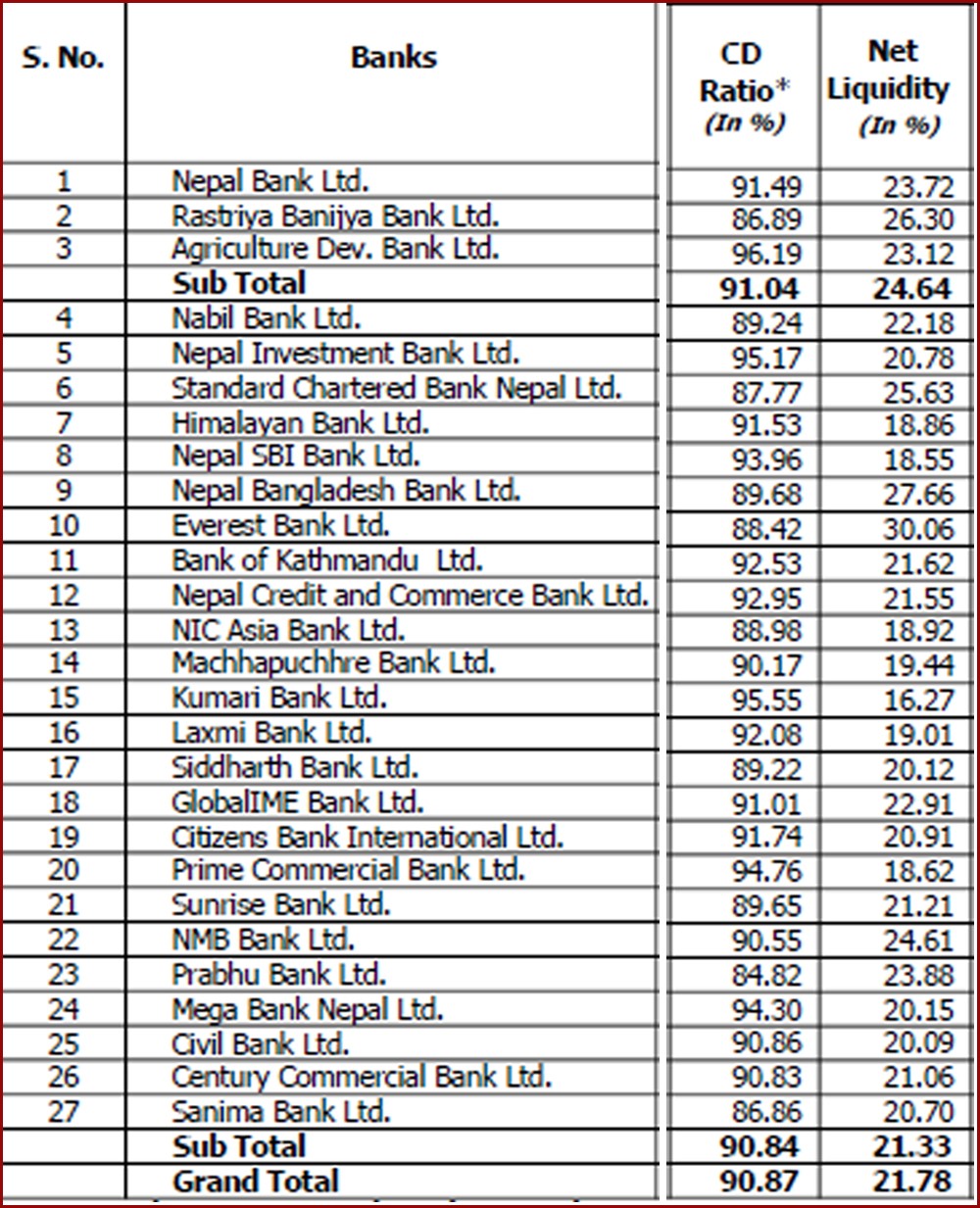

Kathmandu. Due to lack of liquidity, the net liquid assets (NLA) of banks has started to fall below 20 percent. Banks must keep at least 20 percent NLA for the purpose of paying checks. As of mid-December, Rastriya Banijya Bank, Nepal Bank and Krishi Bikas Bank, which also have government investment, have an average NLA of 24.64 percent. The average NLA of private investment commercial banks is only 21.33 percent.

As of mid-December, Everest Bank had the highest NLA and Kumari Bank had the lowest. Everest Bank has 30.06 percent NLA and Kumari Bank has 16.27 percent. 27 commercial banks operating, Himalayan (18.86), Nepal SBI Bank (18.55), NIC Asia Bank (18.92), Machhapuchhre Bank (19.44), Laxmi Bank (19) and Prime Commercial Bank (18). 62) NLA is less than 20 percent.

On an average, the NLA of commercial banks is 21.78 percent. When banks have less liquid assets, withdrawing more deposits at any time can be a problem.