12 trillion 35 billion loan investment by banks in priority areas of Nepal

Mar Thu 2023 03:27:18

742 views

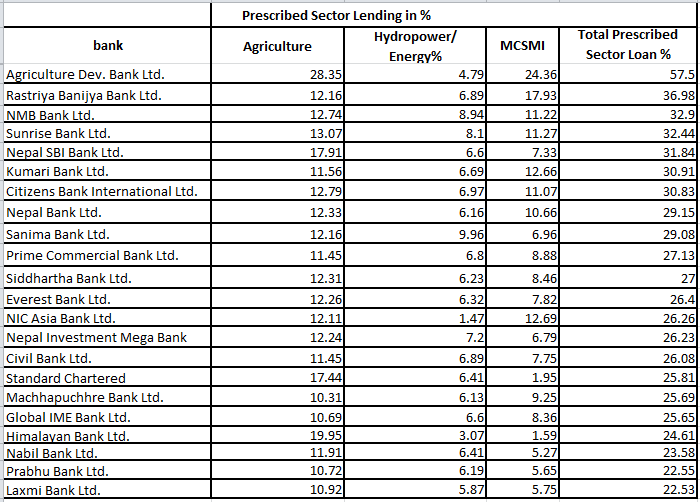

Kathmandu. Commercial banks have provided more than 12 billion loans in priority areas. The data released by Nepal Rastra Bank for the current fiscal year 2079/80 up to the end of December showed this. During that period, 22 commercial banks have made a total of 12 trillion 35 billion 52 lakh rupees in the priority sector. By the end of January, commercial banks have provided a total of 42 trillion 76 billion 334 million rupees in loans.

It has been seen that an average of 28.88 percent of the total loan investment has flowed into priority areas. Banks have invested loans in the fields of agriculture, energy and small, domestic, small and medium enterprises. Out of that, loans have been provided in the ratio of average 13.09 percent in the agriculture sector and 6.29 percent in the energy sector. Similarly, the data mentions that loans were provided in the micro, household, small and medium sector at an average ratio of 9.51 percent

Commercial banks will have to provide loans in the ratio of 32 percent in total to these areas by the end of next June. By the end of June, the National Bank has directed that loans should be provided in the ratio of 13 percent to the agricultural sector, 7 percent to the energy sector, and 12 percent to the micro, domestic, small and medium enterprise sector.

It seems that in agriculture and energy, loans have been disbursed on average according to the specified limits. However, in the micro, domestic, small and medium enterprise sector, it is mentioned in the data that the credit flow is much less than the specified limit. Recently, there has been a contraction in lending due to lack of liquidity. In addition, micro, domestic, small and medium enterprise sectors have been affected due to high prices. Bankers say that there is no possibility of an immediate increase in credit flow in that area.

The National Bank has directed that commercial banks should provide loans in the ratio of 40 percent of the total to priority areas by the end of June 2082. Banks have to provide loans in the ratio of 15 percent in the agricultural sector, 10 percent in the energy sector and 10 percent in the micro, domestic, small and medium enterprise sector. Accordingly, recently, commercial banks have been extending loans to these areas. Banks have to provide loans in the ratio of 35 percent in priority areas till the end of June 81.