Four Commercial Banks Non-performing loans less than 1 percent but Himalayan Bank has highest 4.56

Apr Wed 2023 02:14:26

749 views

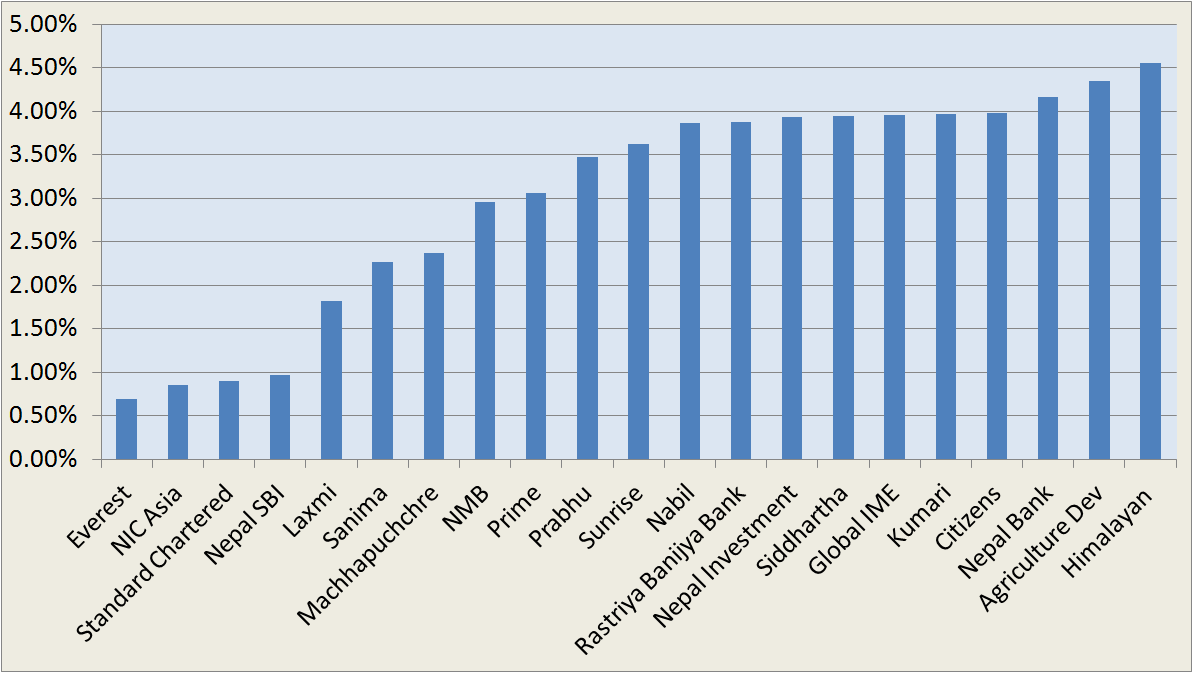

Kathmandu. Commercial banks have published the third quarter financial statements (unrefined) of the current financial year. Everest, NIC Asia, Standard Chartered and Nepal SBI Bank have said that even now only less than 1 percent of their total loans have problems with regular payment.

In the third quarter of the current financial year, Everest Bank said that the lowest non-performing loan was only 0.7 percent. After that, NIC Asia Bank mentioned that there are 0.85 percent non-performing loans. NIC is the most aggressive bank in Nepal and it has been accused of giving many loans based on overvaluation of collateral.

Everest is a bank that still has a large exposure to corporate loans. Whereas, NIC has not given loans to big corporates but to small and medium borrowers. NIC's strategy of giving loans to a large number of small and medium borrowers has now got customers who will repay the loan as it happens even in extreme situations. But now big corporates are not paying their loans. Bankers say that it is impossible for banks that invest in corporates to stay in low non-performing loans at such a time.

Similarly, Standard Chartered and Nepal SBI Bank have also published details of non-performing loans of less than 1 percent. Even the National Bank itself has not taken much interest in the regulation of Standard Chartered. SBI generally does corporate business in Nepal. He also has a large business in trade and payments with India. Lakshmi Bank has also shown that the non-performing loans are still 1.82 percent i.e. less than 2 percent.

Sanima and Machhapuchhre and NMB Bank, which have created the 'brand' with the lowest non-performing loans for a long time, have said that bad loans are between 2 to 3 percent. 10 banks including Prime, Prabhu, Sunrise, Nabil, Rashtriya Banijya, Nepal Investment, Siddharth, Global IME, Kumari and Citizens have said that the rate of non-performing loans is between 3 to 4 percent. Nepal Bank, Krishi Bikas Bank and Himalayan Bank have administered financial statements with bad loans above 4 percent.

Himalayan has published its financial statement stating that the non-performing loan has reached 4.56 percent, which is more than the limit given by the National Bank of 4.4 percent. According to bankers, this financial statement of Himalayan is the most realistic.