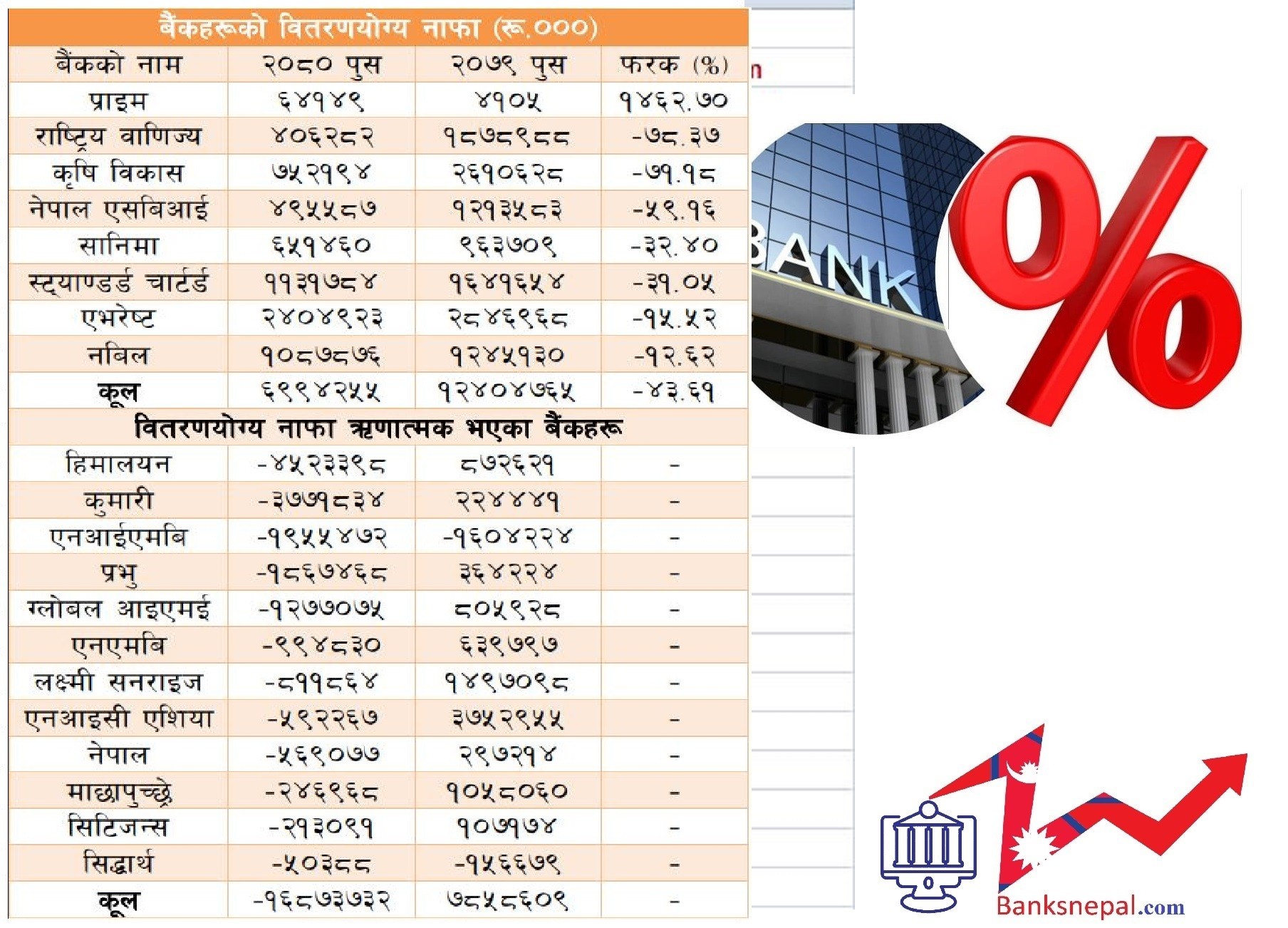

Kathmandu. In the second quarter of the current financial year 2080/81, the distributable profit of most of the commercial banks is negative. According to the data released by the banks, the distributable profit of 12 commercial banks is negative and 7 banks have decreased till the end of December.

Till the end of January, the distributable profit of 12 commercial banks is negative by about 17 billion rupees. According to the statistics released by the banks, 12 commercial banks have a negative balance of Rs 16.87 billion 37 million by the end of December.

During this period, Himalayan's 4.52 billion rupees, Kumari's 3.77 billion rupees, Nepal Investment Mega Bank's 1.95 billion rupees, Prabhu Bank's 1.86 billion rupees, NMB Bank's distributable profit is 99.48 million rupees.

Laxmi Sunrise Bank Rs 81 crore 18 lakh, NIC Asia Bank Rs 59 crore 22 lakh, Nepal Bank Rs 56 crore 90 lakh, Machhapuchhre Bank Rs 24 crore 69 lakh, Citizens Bank Rs 21 crore 3 lakh and Siddharth Bank Rs 5 crore 3 lakh The rupee is negative.

During the review period, Prime Bank has increased by 1,462 percent. During this period, the bank has a distributable profit of Rs.641 million.

The distributable profit of Rastriya Commerce, Krishi Bikas Bank, Nepal SBI Bank, Sanima Bank, Standard Chartered Bank, Everest Bank and Nabil Bank was positive but decreased by 43.61 percent compared to last year. These banks have a distributable profit of 6.99 billion rupees till the end of January. During the same period last year, the distributable profit was 12.4 billion rupees.

National Commercial Bank decreased by 78.37 percent to Rs 406.2 million, Krishi Bikas Bank decreased by 71.18 percent to Rs. 752.1 million, Nepal SBI Bank decreased by 59.16 percent to Rs. 495.5 million, Sanima Bank decreased by 32.40 percent to Rs. There is a distributable profit of Rs.14 lakh crore.

The distributable profit of Standard Chartered Bank decreased by 31.05 percent to 1.13 billion rupees, 15.52 percent by Everest decreased by 2.40 million rupees and Nabil decreased by 12.62 percent to 1.8 billion rupees.