Banks interest rate in Nepal : Top 20 Commercial Banks interest Rate on Chaitra 2080

Mar Wed 2024 03:37:29

3111 views

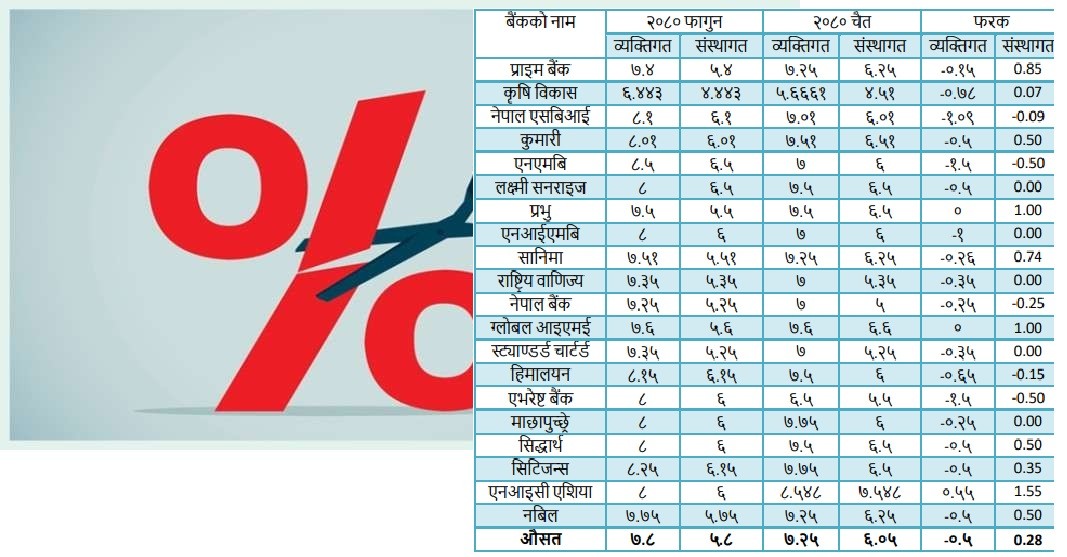

Kathmandu. Most of the banks have reduced the interest rate of fixed deposits for the month of March. Commercial banks, which have been continuously reducing interest rates since the liquidity eased recently, have also reduced them in March.

The interest rate reduced by the banks will be effective from 1st of Chait. However, after the Nepal Rastra Bank arranged that the difference between institutional and individual deposits would be 1 percent, it seems that the interest rate of some banks on institutional deposits has increased.

According to the interest rates published by the banks, the average rate of term deposits has decreased by 0.50 percent on the individual side, while the interest rate on the institutional side has increased by 0.28 percent.

Prime Bank's fixed deposit interest rate has been reduced by 0.15 percent to 7.25 percent for individuals, while the interest rate for institutions has increased by 0.85 percent to 6.25 percent. Earlier in February, the interest rate was set at 5.4 percent for institutions and 7.4 percent for individuals.

Interest will be increased by 0.07 percent to 4.51 percent on the institutional side of Krishi Bikas Bank and 0.78 percent on the individual side to 5.6661 percent. Earlier in February, the bank had set interest rates of 4.443 percent for institutions and 6.443 percent for individuals.

Nepal SBI Bank has reduced the interest rate from 1.09 percent to 7.01 percent for individuals and 6.1 percent for institutions. Earlier in February, the bank had set an interest rate of 8.1 percent for individuals and 6.1 percent for institutions.

Kumari Bank has reduced the interest rate for individuals by 0.50 percent to 7.51 percent and increased it by 0.50 percent to 6.51 percent for institutions. Earlier in February, the interest rate was set at 8.01 percent for individuals and 6.01 percent for institutions.

NMB Bank has reduced the interest rate from 1.5 percent to 7 percent for individuals and 0.5 percent to 6 percent for institutions. Earlier in February, the bank had set an interest rate of 8.5 percent for individuals and 6.5 percent for institutions.

Laxmi Sunrise Bank has reduced the personal interest rate by 0.50 percent to 7.5 percent and the institutional interest rate to 6.5 percent. Earlier in February, 8 percent interest was provided to individuals and 6.5 percent interest to institutions.

Prabhu Bank has decided to increase the interest rate to 6.5 percent for individuals and 1 percent for corporates by 7.5 percent. Earlier in February, the bank had fixed 7.5 percent interest rate for individuals and 5.5 percent interest rate for institutions.

Nepal Investment Mega Bank has reduced the interest rate from 1 percent to 7 percent for individuals and 6 percent for institutions. Earlier in February, the bank had set 8 percent interest rate for individuals and 6 percent interest rate for institutions.

Sanima Bank has reduced the personal interest rate by 0.26 percent to 7.25 percent and the institutional interest rate by 0.74 percent to 6 percent. Earlier, in February, the bank had set an interest rate of 7.51 percent for individuals and 5.51 percent for institutions.

The National Commercial Bank has reduced the interest rate from 0.35 percent to 7 percent for individuals and 5.35 percent for institutions. Earlier in February, the bank fixed the interest rate of 7.35 percent for individuals and 5.35 percent for institutions.

Nepal Bank has reduced the interest rate by 0.25 percent to 7 percent for individuals and 5 percent for institutions. Earlier in February, 7.25 percent interest rate was set for individuals and 5.25 percent interest rate for institutions.

Global IME Bank has increased the interest rate to 7.6 percent for individuals and 1 percent to 6.6 percent for institutions. In February, the bank set an interest rate of 7.6 percent for individuals and 5.6 percent for institutions.

Standard Chartered Bank has reduced the interest rate of 0.35 percent to 7 percent for individuals and 5.25 percent for institutions. Earlier in February, the bank had fixed the interest rate of 7.35 percent for individuals and 5.25 percent for institutions.

Himalayan Bank will provide 0.65 percent interest rate for individuals to 7.5 percent and 0.15 percent to 6 percent for institutions. Earlier in February, it provided 8.15 percent interest rate for individuals and 6.15 percent interest rate for institutions.

Everest Bank has reduced the personal interest rate by 0.15% to 6.5% and the institutional interest rate by 0.5% to 5.5%. Earlier in February, the interest rate was set at 8 percent for individuals and 6 percent for institutions.

Machhapuchhre Bank has reduced the interest rate by 0.25 percent to 7.75 percent for individuals and 6 percent for institutions. Earlier in February, the interest rate was set at 8 percent for individuals and 6 percent for institutions.

Siddharth Bank has decided to reduce the interest rate by 0.5 percent to 7.5 percent for individuals and increase it by 0.5 percent to 6.5 percent for institutions. Earlier in February, the bank had set 8 percent interest rate for individuals and 6 percent interest rate for institutions.

Citizens Bank has reduced the personal interest rate by 0.5 percent to 7.75 percent and the institutional interest rate by 0.35 percent to 6.5 percent. Earlier in February, the bank had fixed the interest rate of 8.25 percent for individuals and 6.15 percent for institutions.

Nabil Bank has reduced the personal interest rate by 0.5 percent to 7.25 percent and the institutional interest rate by 0.5 percent to 6.25 percent. Earlier in February, the bank had fixed 7.75 percent interest rate for individuals and 5.75 percent interest rate for institutions.

NIC Asia Bank has increased the interest rate by 0.55 percent to 8.548 percent for individuals and 1.55 percent to 7.548 percent for institutions. Earlier in February, the bank had set 8 percent interest rate for individuals and 6 percent interest rate for institutions.