Corona effect

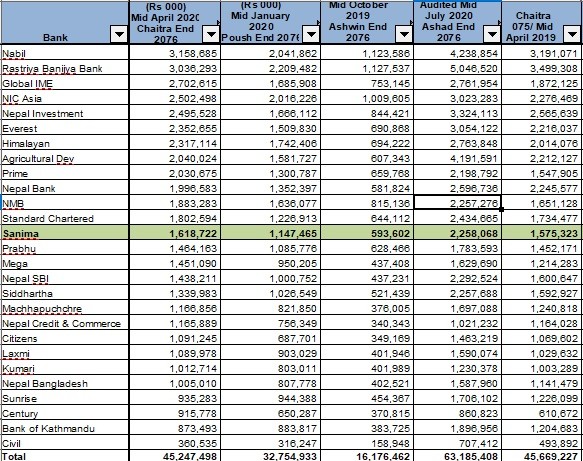

Kathmandu. 27 commercial banks have earned a profit of Rs 12 billion till the third quarter of the current fiscal year. The income of the banking and financial sector has declined in the three months from January to April after the closure of business due to Covid-19.

Commercial banks made a profit of Rs 21.10 billion in the second quarter, which has now come down to Rs 12 billion. Due to the coronation, the distributable profit of the banks has decreased as the general borrowers have not even paid the interest and installment of the loan. According to the NFRS, the distributable profit of the banks has declined as the bank's financial statements do not show the distributable profit.

Distributable profit of Sunrise Bank, Civil Bank, Nepal Bank, Laxmi Bank Bank of Kathmandu and Siddhartha Bank has been negative. Lakshmi Bank has the highest distributable profit in the negative. Lakshmi Bank has more than Rs 410 million in negative.

Similarly, Civil Bank has more than Rs 290 million, Siddhartha Bank has more than Rs 150 million, Sunrise Bank has more than Rs 170 million, Bank of Kathmandu has more than Rs 90 million and Nepal Bank has more than Rs 60 million. In mid-April, the banks' profits have been low due to the large amount of money set aside for their risk due to non-recovery of capital and interest.

NMB Bank, Standard Chartered Bank and Sanima Bank have made a profit of over Rs 1.5 billion and Prabhu Bank, Mega Bank, Nepal SBI Bank, Siddhartha Bank, Machhapuchhre Bank, NCC Bank, Nepal Bangladesh Bank, Citizens Bank, Laxmi Bank and Kumari Bank have made a profit of over Rs 1.5 billion. Are Similarly, Sunrise Bank, Century Commercial Bank, Bank of Kathmandu and Civil Bank have made a profit of less than Rs 1 billion, according to their financial statements.