Commercial banks 31.5 trillion deposit & 27.5 trillion loan investment in Q3

May Fri 2020 09:34:39

1586 views

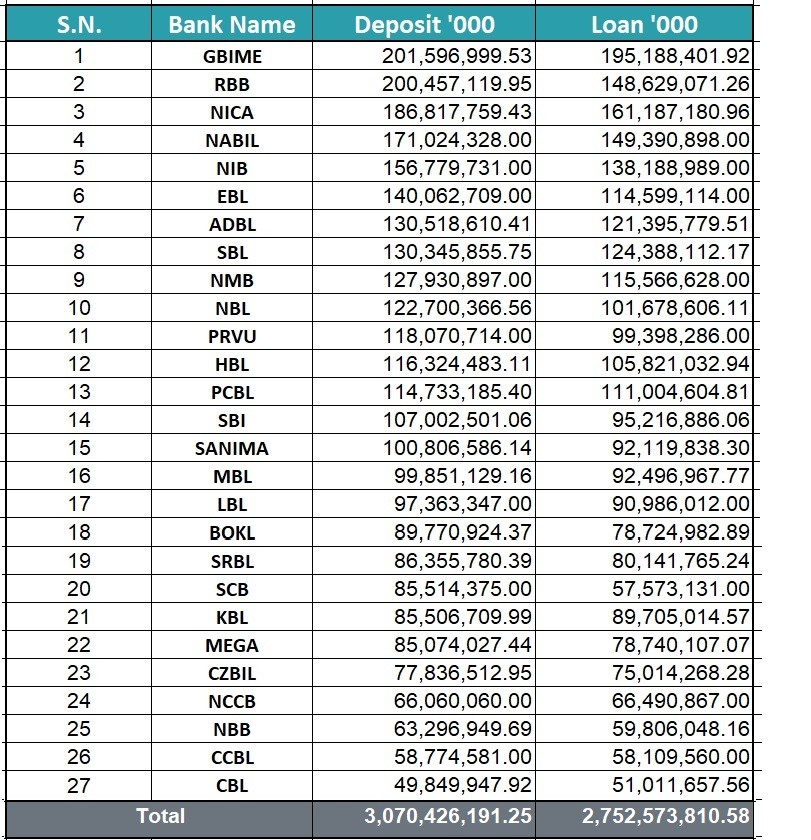

The 27 commercial bank has published its third quarter (Q3) report of FY 2076/77.

The report shows Deposits of commercial banks have exceeded Rs. 3.07 trillion in the first nine months of the current fiscal year. The 27 commercial banks operating in the banks till mid-April have collected deposits worth Rs 3,070.42 billion.

Similarly, these banks have invested a total of Rs. 2752.57 billion as of mid-April.

In the corresponding period of the previous year (up to mid-April), the total deposit collection of 27 commercial banks was Rs. 2458.42 billion and credit investment was Rs. 2209.58 billion.

Global IME Bank, which merged with Janata Bank, has the highest deposit collection of over Rs 211 billion during this period, while the state-owned Rastriya Banijya Bank has also collected over Rs 200 billion. Of the 27 banks, 15 have deposits above Rs 100 crore and 12 have deposits below. Civil Bank has the lowest at Rs 49.84 billion.

Similarly, Global IME Bank is also in the forefront in terms of credit investment. NIC Asia Bank, which is in the second place, has invested Rs 161 billion while the bank has invested Rs 185 billion. NIC Asia's credit investment is Rs 12.55 billion more than the state-owned Rastriya Banijya Bank.

Deposit collection amount of banks increased by Rs. 612.30 billion and credit investment increased by Rs. 542.98 billion during the review period. In percentage terms, the growth was 24.91 percent in deposits and 24.57 percent in credit investment.

The average deposit collection of commercial banks during the review period was Rs. 113 billion and average credit investment was Rs. 101 billion.