What is a book close? How to adjust the price in bonus entitlement ?

Oct Fri 2020 06:32:28

4642 views

Companies maintain a register of shareholders. Before the general meeting, distribution of dividends and issuance of right shares, the shareholders close the book for a certain period of time so that the registration of shares is not rejected and the name is not transferred.

Companies, in particular, close their books in order to decide the date on which the existing shareholders will participate in the general meeting and to pay dividends and bonus shares and entitled shares. In this way, shares can be bought and sold even during the book closing period. However, the return announced by the company will be received only by the shareholders who remain before the book close.

The market share price of the company is adjusted on the day of book closing for bonus shares and rights shares. The price has been adjusted as the number of shares will be increased by giving bonus and entitled shares. But when the price is adjusted, the share price of the company decreases. Therefore, investors who buy and sell shares should be vigilant in this regard as well.

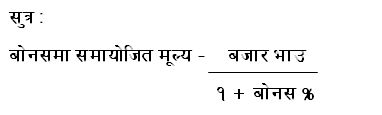

There are different methods for adjusting the price of bonus and entitled shares. After the issuance of bonus shares, the market price of the company should be divided by adding 1 to the bonus share percentage to get the adjusted price. The last trading price of the day before the market price book closing should be taken.

The method of calculating the adjusted price on the right shares is somewhat different. In order to find the adjusted share price in the rights issue, first the per share price of the rights shares should be multiplied by the rights issue percentage and linked to the market price. Dividing this number by the addition of 1 to the right share percentage, the adjusted value is maintained. It should be noted that in Nepal, the right share is issued at Rs 100 per share. Therefore, the price of the right share should be Rs 100 per share.