9 Bank declared Dividends but Kumari and Nepal Investment Bank has declined

Oct Fri 2021 12:22:56

1427 views

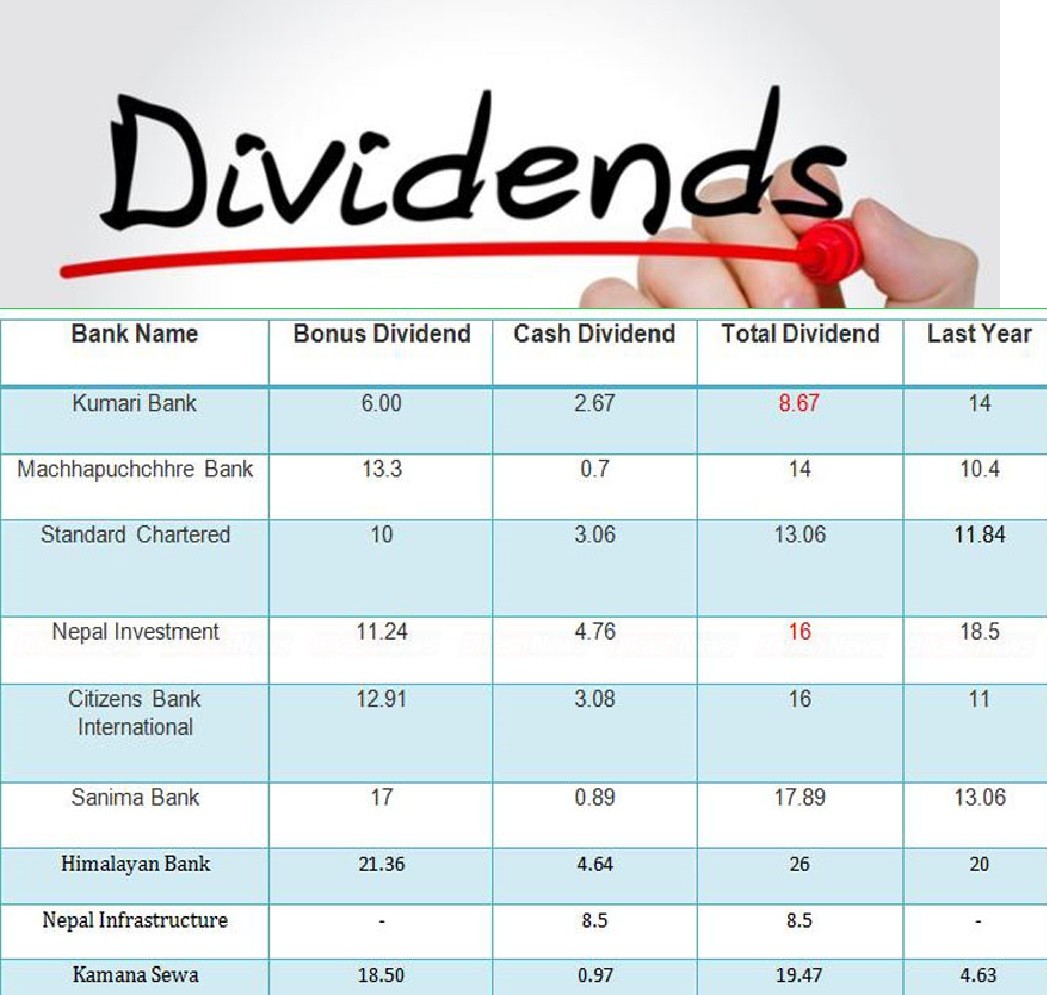

Kathmandu. Seven commercial banks, one infrastructure development bank and one development bank have declared dividend. Of the banks that declared dividend to the shareholders from the last fiscal year's profit, the dividend of Kumari Bank and Nepal Investment Bank has decreased compared to the previous fiscal year while the others have increased.

So far, Machhapuchhre, Sanima, Kumari, Citizens Bank International, Nepal Investment, Standard Chartered and Himalayan Bank, Nepal Infrastructure Bank and one development bank, Kamana Seva, have declared dividends from the last fiscal year's profit.

Himalayan Bank has the highest number of dividend offers. Himalayan Bank's total dividend is 26 percent. The bank has proposed to pay a total dividend of 26 percent with 21.36 percent bonus share and 4.64 percent cash dividend.

Machhapuchhre Bank has proposed to distribute 14 percent dividend to the shareholders from the last fiscal year's profit. The bank has proposed to pay 13.30 percent bonus of the paid up capital and 0.70 percent cash for tax purposes and 14 percent dividend from the profit of the fiscal year 2077/78.

Sanima Bank has also proposed to distribute 17.89 percent dividend to the shareholders from the last fiscal year's profit. Citizens Bank International has also announced to distribute 16 percent dividend to the shareholders.

Nepal Investment Bank has also announced to distribute 16 percent dividend to the shareholders. The bank has offered 11.24 percent bonus and 4.76 percent cash dividend. Kumari has declared a dividend of 8.67 percent.

Standard Chartered Bank has declared a dividend of 13.06 percent. The bank has proposed a total dividend of 13.06 percent with 10 percent bonus and 3.06 percent cash (including tax) from the last fiscal year's profit.

Similarly, Nepal Infrastructure Bank (NIFRA) has announced to distribute 8.5 percent cash dividend to the shareholders while Kamana Seva Bikas Bank has also announced to distribute 19.47 percent dividend to the shareholders.