Kathmandu. The share price of United Modi Hydropower Limited (UMHL) has decreased by Rs 23 10 paise this week. The shares of this company, which last traded at 313 rupees last week, were last traded at 289 rupees 90 paisa this week. According to this, if the share price of the company rises in the coming week, it will face resistance at Rs 360. Similarly, if the share price of the company falls, it seems to get support at Rs. 240.

The company's 5-day EMA is above the 20-day EMA. However, this week the gap between the two is narrowing. This indicates that the buying momentum in the market is weakening. In the coming week, if the 5-day EMA crosses the 20-day EMA, it will form a dead crossover, which indicates that the company's share price will fall.

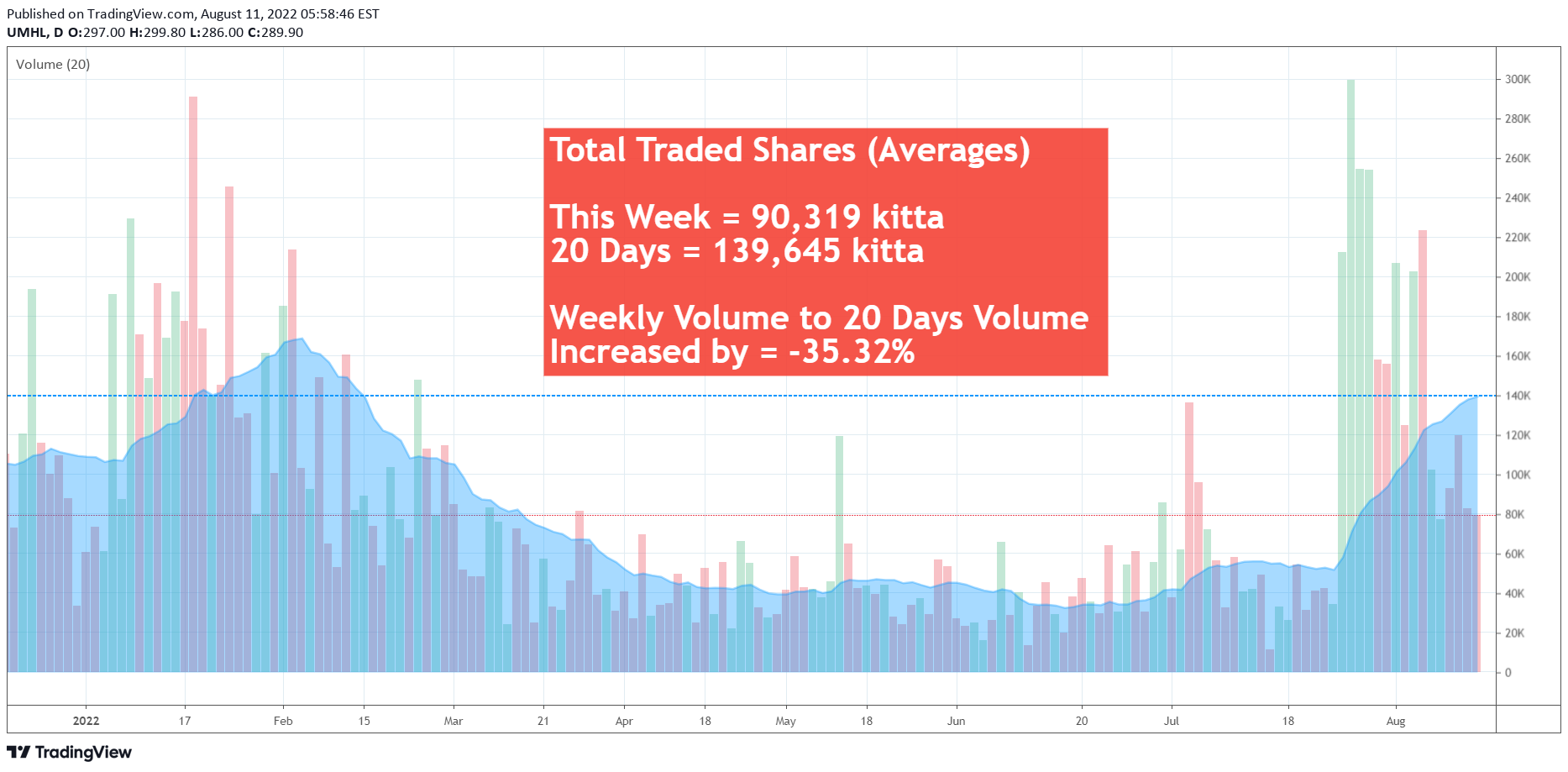

This week, the company's share price has also decreased along with the volume. This week, the company's daily average was 90,319 shares. With this, the company's 20-day average volume has reached 139,645 shares. The daily average volume is 35.32 percent lower than the 20-day average volume.

It has earned a profit of Rs 2 crore 74 lakh till the end of March of the last financial year. In the same period of the previous financial year, the company had earned a profit of Rs. As the company's income decreased, the net profit decreased.

During the review period, the operating income of the company has decreased from 226.3 million to 181.3 million. Similarly, the total profit of the company decreased from 21.79 million to 17.14 million, while other income increased from 1.4 million to 3.81 million.

The company received compensation of 36.5 million 22 thousand rupees from insurance during that period. Currently, the company's paid-up capital is 1.15 billion rupees. The reserve fund of the company is Rs.10 crore 45 lakhs.