Top 5 Commercial bank of Nepal Dividend History : Everest , NIC , Sanima, Standard Chatter and Machhapuchhre Bank

Aug Sun 2023 04:45:37

1596 views

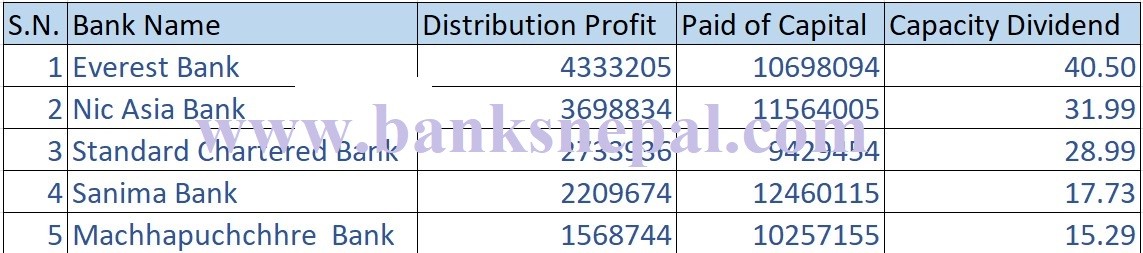

Kathmandu. Currently operating commercial banks have published their financial statements for the last financial year. Among the currently operating commercial banks, only seven commercial banks can pay dividends above 15 percent this year, according to the data. Looking at the financial health of the financial year 2079/80, it is seen that Everest Bank, NIC Asia Bank, Standard Chartered Bank, Machhapuchhre Bank and Sanima Bank can give good returns to the investors from the profits of the last financial year.

This year, Everest Bank seems to announce the best dividend to the investors. Everest Bank has the ability to give 40.50 percent dividend to investors compared to last financial year. Similarly, NIC Asia Bank, which has not been able to declare dividends due to financial constraints, is the second bank that can declare the highest dividend. The bank has the ability to declare 31.98 percent dividend compared to last financial year. Similarly, Standard Chatter Bank can give 28.99 percent, Sanima Bank 17.73 percent, Machhapuchhre Bank 15.29 percent dividend to their shareholders.

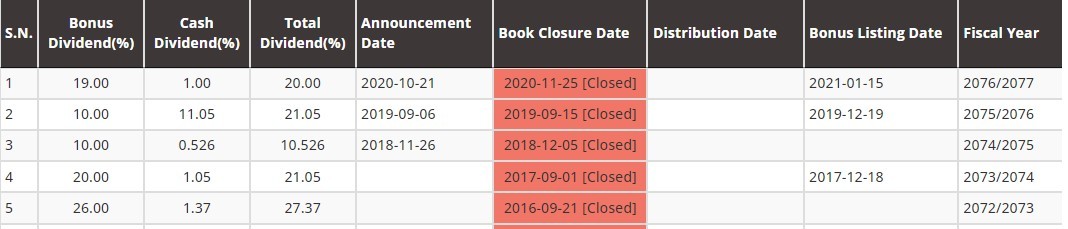

Everest Bank :The paid up capital of Everest Bank is 10.69 billion rupees. The distributable profit of the company is 4 billion 33 crore rupees. The company's ability to pay dividends is above 40 percent.

Everest Bank :The paid up capital of Everest Bank is 10.69 billion rupees. The distributable profit of the company is 4 billion 33 crore rupees. The company's ability to pay dividends is above 40 percent.

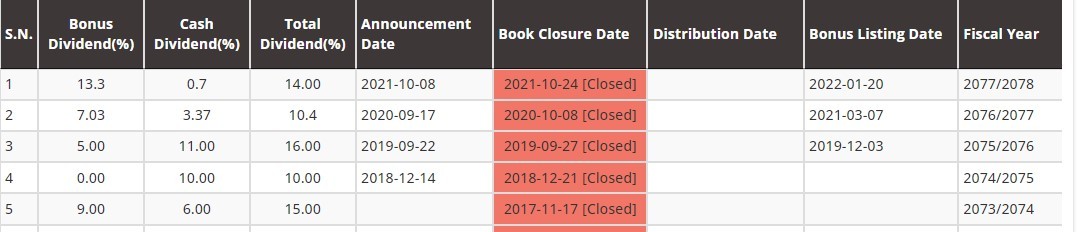

If we look at the dividend history, for the last five years, the company has not been able to give a reasonable return to its investors above 20 percent. If we look at the history of five years, Everest Bank has the ability to give the highest dividend this year.

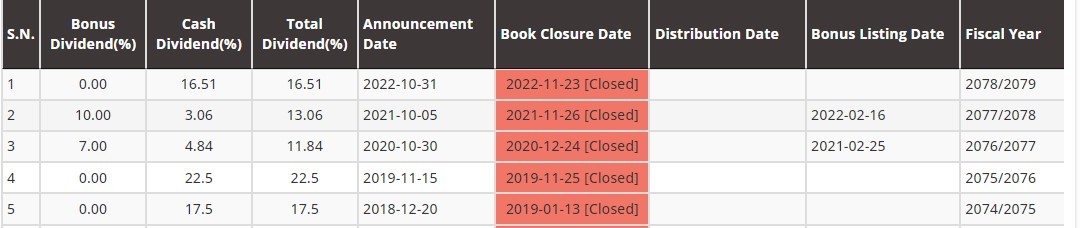

NIC Asia Bank: NIC Asia Bank's paid-up capital is Rs 11.56 billion. The distributable profit of the bank is 3.69 billion rupees. The dividend distribution capacity of the company is 31.1498 percent. NIC Asia Bank, which has not been able to distribute dividends to investors due to lack of funds for two financial years, investors hope that NIC Asia Bank will be able to distribute dividends this year.

NIC Asia Bank: NIC Asia Bank's paid-up capital is Rs 11.56 billion. The distributable profit of the bank is 3.69 billion rupees. The dividend distribution capacity of the company is 31.1498 percent. NIC Asia Bank, which has not been able to distribute dividends to investors due to lack of funds for two financial years, investors hope that NIC Asia Bank will be able to distribute dividends this year.

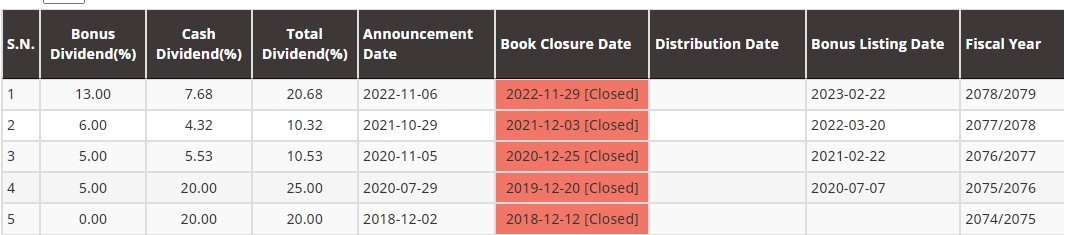

The National Bank has not yet published the CCRC. If the CCRC is not reached, the bank will not be allowed to distribute dividends again. The bank has not been able to distribute dividends above 27 percent for the past five years.

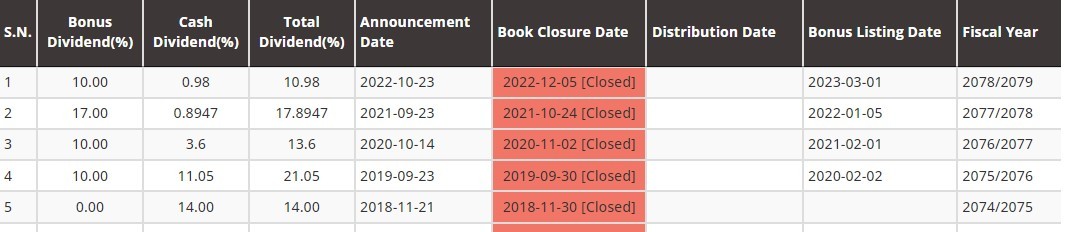

Standard Chatter Bank: Standard Chatter Bank's paid-up capital is Rs 9.42 billion. The distributable profit of the bank is 2.73 billion rupees. The dividend distribution capacity of the bank is 28.93 percent. The bank has been declaring dividends below 20 percent for five years. This year, it has the ability to give dividends of around 30 percent.

Standard Chatter Bank: Standard Chatter Bank's paid-up capital is Rs 9.42 billion. The distributable profit of the bank is 2.73 billion rupees. The dividend distribution capacity of the bank is 28.93 percent. The bank has been declaring dividends below 20 percent for five years. This year, it has the ability to give dividends of around 30 percent.

Sanima Bank: The paid up capital of Sanima Bank is 12.46 billion rupees. The distributable profit of the bank is 2 billion 20 crore rupees. The dividend distribution capacity of the bank is 17.73 percent.

Sanima Bank has been paying dividends below 15 percent for the past five years. After five years, it is seen that the company is going to pay a dividend of 15 percent.

Machhapuchhre Bank : The paid-up capital of Machhapuchhre Bank is 10 billion 25 crore rupees. The distributable profit of the bank is 1.56 billion rupees. The dividend distribution capacity of the bank is 15.29 percent. The data shows that the bank, which has been paying dividends below 15 percent for the past five years, has the ability to pay dividends above this.