Non Performing Loans (NPL) Of Commercial Banks of Nepal has increasing 2080/081

Nov Mon 2023 01:47:14

1215 views

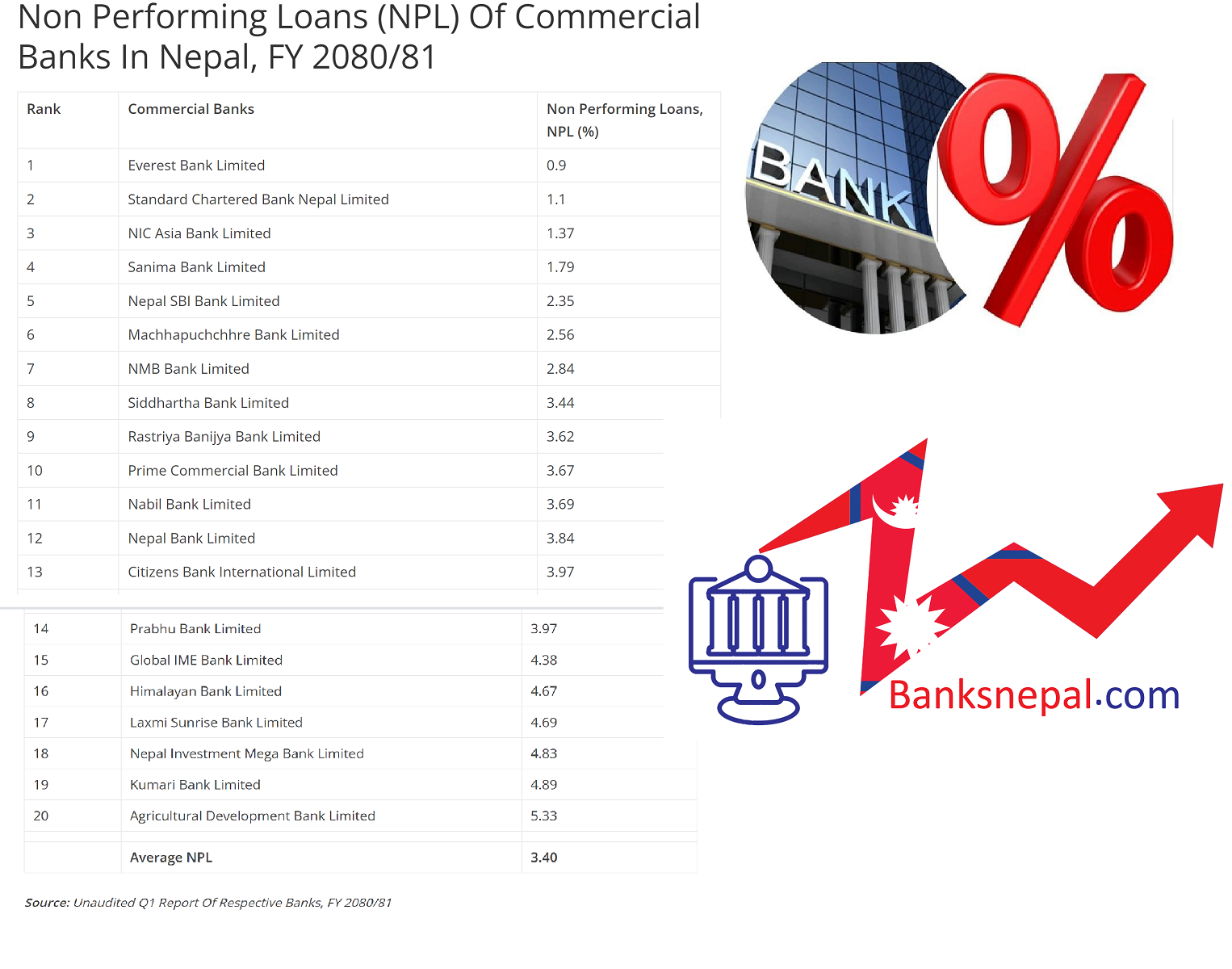

Kathmandu. Bad loan ratio of commercial banks is increasing. At present, such loans of banks have reached about three and a half percent. This is shown in the first quarter financial statements of the current financial year 2080/81 published by the banks recently.

As of Ashwin's end of the last fiscal year 2079/80 BS, the average Non Performing Loans (NPL) of 20 commercial banks has inclined to 3.40 percent as compared to 2.80 percent in the end of Ashad, 2080 BS. Only one bank has NPL lower than one percent.

According to the details, the average bad loan ratio of banks has reached 3.39 percent in the first quarter of the current year. Which is 103.53 percent more than the first quarter of last year. In the same period last year, the ratio of such loans with banks was only 1.66 percent. During the review period, such loans of some banks were seen to be out of control. With the increase in bad loans, the profitability of banks has also been affected. Especially due to the economic recession, the loans provided by the banks could not be recovered on time. Due to non-payment of principal and interest on time, bad loans of banks have more than doubled. Banks' loan recovery has not been completed due to economic stagnation.

Especially due to the recent economic crisis, the loans of the banks have not been recovered. Due to the financial crisis, there was a decline in business income in most areas. As a result, the debtors' ability to pay their debts decreased. Due to high cost, high cost, high interest rate etc., the ability of borrowers to repay the loan has decreased, as a result, they are not even able to pay the loan installments and interest. Due to this, the bad loans of the banks automatically increased. The situation has not returned to normal. All debts have not been recovered. As a result, the bad debt ratio has not returned to normal levels, experts say. If the borrower does not pay the loan amount and interest for 6 months, such loan will be classified as bad loan.

In the first quarter of the current year, bad loans of the Agricultural Development Bank have exceeded the limit of 5 percent. In the first quarter, such loans of the bank reached 5.33 percent. However, during the same period last year, such loans of the bank were only 2.38 percent. Especially the bad loans of banks that have gone to mergers are increasing.

Second most bad loans are seen with Kumari Bank. By the end of October, the bad loans of Kumari Bank have reached 4.89 percent. During the same period last year, such loans of the bank were only 1.28 percent. The bank merged with former NCC Bank last year.

Similarly, bad loans of Nepal Investment Mega Bank, which earned the most profit in the first quarter, were also seen at 4.83 percent. On the other hand, Lakshmi Sunrise's bad loans are 4.69 percent, Himalayan Bank's 4.67 percent and Global IME Bank's 4.38 percent.

However, during the review period, Everest Bank has the least bad loans. The bank's bad loan ratio is below 1 percent. In the first quarter, the bank has only 0.9 percent bad loans. Similarly, Standard Chartered Bank's bad loans are 1.1 percent, NIAC Asia's 1.37 percent and Sanima Bank's 1.79 percent. The bad loans of these banks are less than others.

Apart from these, bad loans of commercial banks are above 2 percent. During the review period, bad loans of Citizen Bank were 3.97 percent, Prabhu's 3.97, Nepal Bank's 3.84, Nabil's 3.69, Prime's 3.67, National Commercial Bank's 3.62 and Siddharth Bank's 3.44 percent. On the other hand, NMB Bank has 2.84 percent, Machhapuchhre has 2.56 percent, and Nepal SBIA Bank has 2.35 percent.