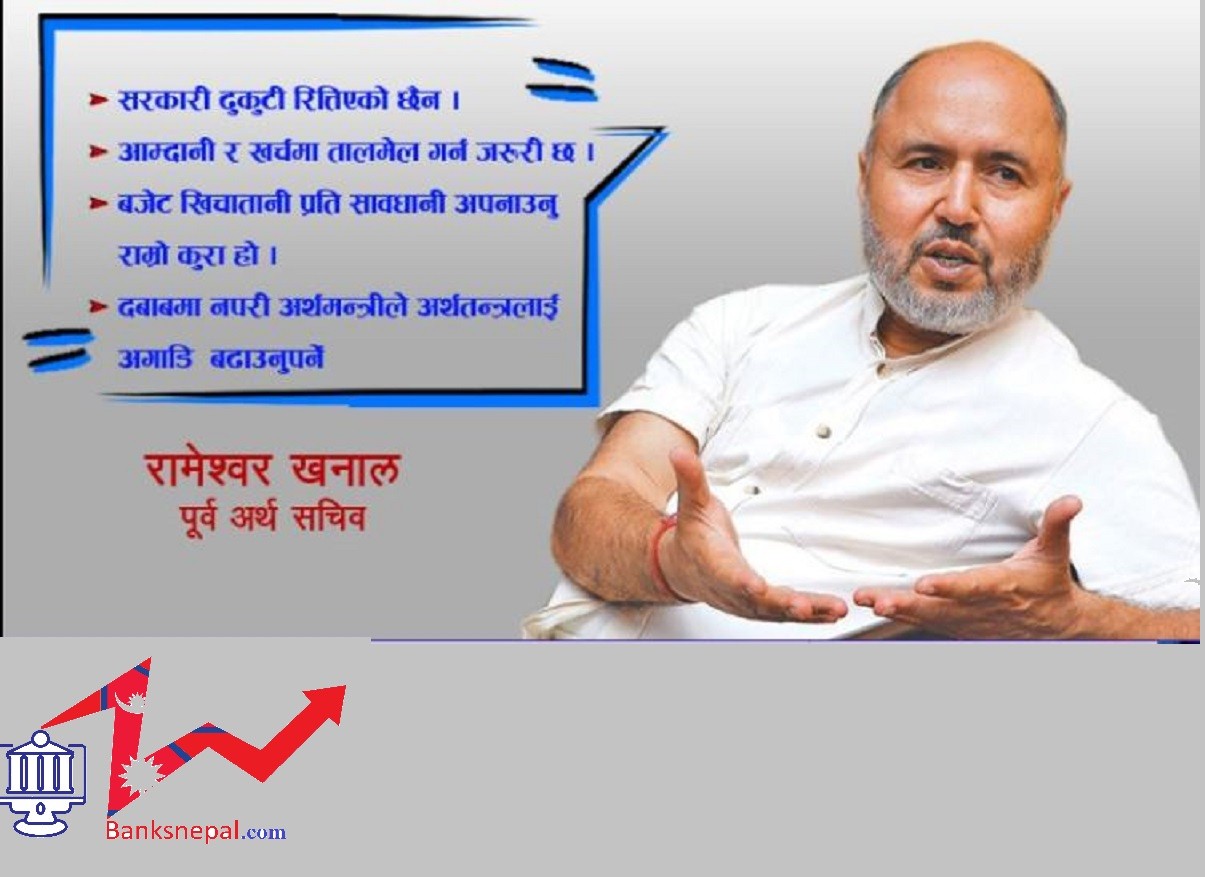

We are not in Sri Lanka Path, but if We careless same way may be soon, Sri Lanka _ Rameshwor Khanal

Apr Sat 2022 12:27:06

Kathmandu. The government's financial position is still good. Our revenue is sufficient to pay the principal and interest of foreign loans. This time, the principal and interest of the loan that Nepal has to repay is around Rs 45 billion. We have over one trillion rupees in revenue. Looking at it this way, we seem to be able to repay the foreign debt.

At present, the tourism sector is also in a state of general improvement. The activity in this area is gradually increasing. However, the improvement in the tourism sector will not improve the Nepalese economy. The tourism sector has contributed only 7 percent to the GDP. Increasing activity in the tourism sector will do some good to the Nepalese economy. However, the economy will not improve.

Rumors are circulating in the market that Nepal is on its way to Sri Lanka. The burden of Sri Lanka's foreign debt is very high. They cannot repay the loan without foreign currency. Not only that, their revenue collection is also very weak. However, our revenue collection in Nepal is strong. Seen in this light, we are not yet in Sri Lanka. However, at this rate, it would not take long to reach Venezuela via Sri Lanka.

Due to the increase in imports, a large amount of foreign currency flowed out of Nepal. When the foreign currency leaves, the Nepali currency returns to the National Bank. The Nepali currency that you have is to be given to Rashtra Bank and bought from there and sent abroad. When importing Nepali currency, the circulation in the market should also decrease. But, here the opposite happened.

NRB sent huge amount of cash to banks. Foreign exchange reserves decreased, imports increased. Similarly, in case the circulation of Nepali currency had to decrease, the circulation of Nepali currency increased. When this happened, people got loans at cheap interest rates. Purchasing power increased when money reached their hands. They went to the market to buy the same. However, most of the goods that come to Nepal are imported from abroad. Due to this, imports increased tremendously.

When the foreign exchange reserves decreased, the money supply naturally declined, but the NRB was generous and increased the money supply. Nepal is our country which has more money supply in South Asia than Bangladesh, Sri Lanka, Pakistan and India. In India alone, only 81 percent of the country's gross domestic product is supplied. If they produce 100 items in a year, they will get only 81 rupees. However, when there is a production of one hundred in Nepal, there is a situation where money up to Rs. 120 is available in the market.