Category/expert-speak (Total Articles : 60 )

Economic indicators are also positive in Covid- 19 ; Governor, Maha Prasad Adhikari

Kathmandu, Governor of Nepal Rastra Bank, Maha Prasad Adhikari, during discussions with the chief executive officers of banks and financial institutions, said that the indicators of the economy were positive even during the time of Corona Virus Covid-19 in Nepal. Governor...

Read More

Monetary policy encourages bankers and businessmen

Kathmandu. Entrepreneurs and banker's have said that the monetary policy has been good in the fiscal year 2077/78. President of the Federation of Nepalese Chambers of Commerce and Industry Bhavani Rana and former president of the Nepal Backers Association and some backers said that the...

Read More

Monetary policy focus on loan utilization - Dipendra Bahadur Chhetri, Former Governor

Former Governor of Nepal Rastra Bank, Dipendra Bahadur Kshetri, has said that the monetary policy for the coming fiscal year should focus on re-utilizing loans.Stating that the NRB is going to increase the size of the loan fund again to...

Read More

Encouragement of Big Merger, NRB's new monetary policy - Deputy Governor Shivakoti

Kathmandu. Nepal Rastra Bank is going to give top priority to Big Merger in the upcoming monetary policy. NRB is about to take a new policy to halve the existing commercial banks according to the market of Nepal's economy. At present, there are 27 commercial...

Read More

If capital had not been raised, banks would be in trouble now - Chiranjibi Nepal, Former governor

Former Governor of Nepal Rastra Bank Dr. Chiranjeevi Nepal has said that the autonomy of NRB should be strengthened. Stating that the NRB is capable and autonomous in itself, he expressed concern that the NRB Act Second Amendment Bill could weaken the NRB. He also...

Read More

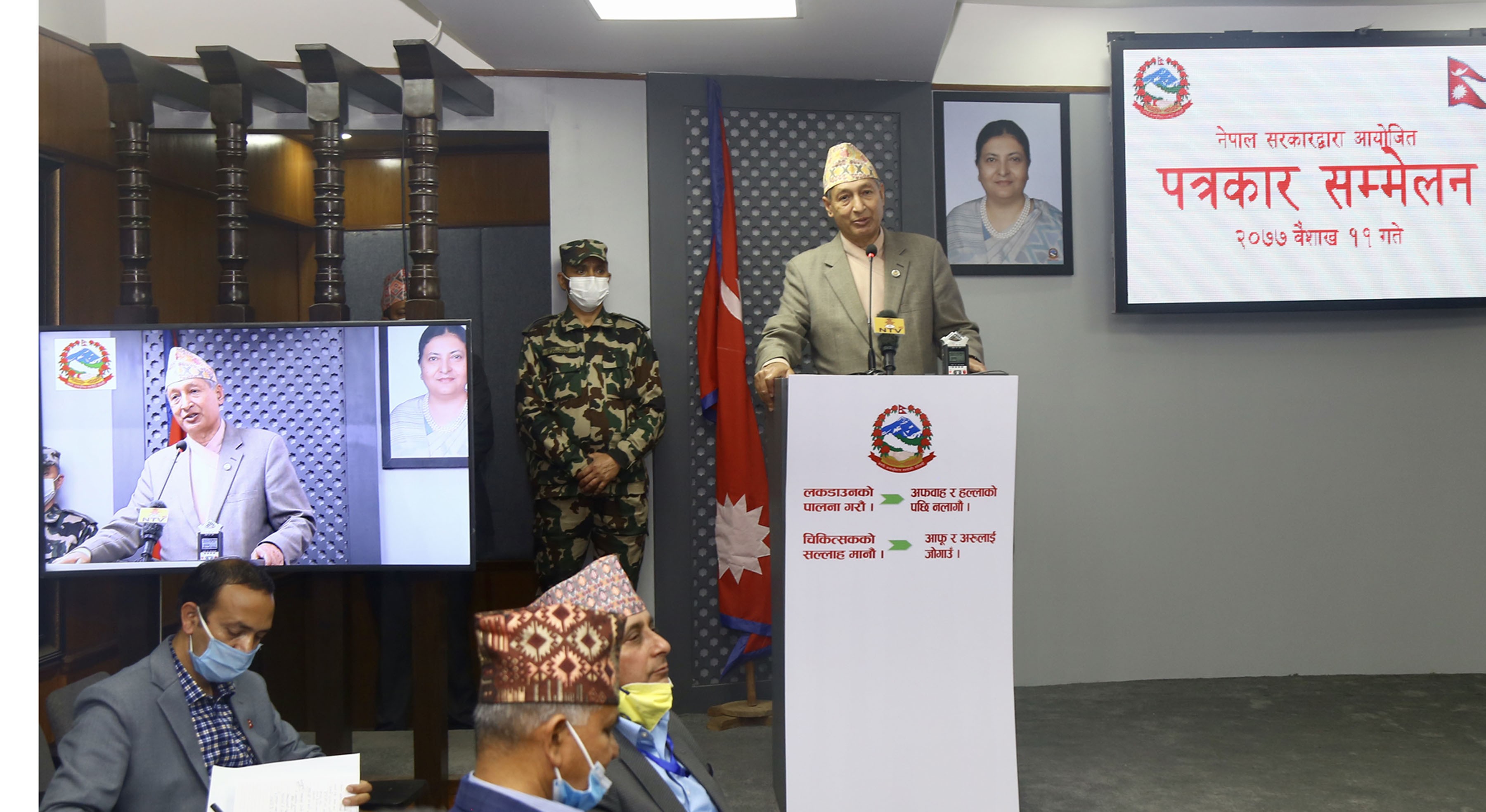

The bank's spread rate comes to 4 percent - Finance Minister

Kathmandu. Finance Minister Dr. Yuvaraj Khatiwada has said that the spread rate will fall to 4 percent by mid-July.The spread rate, which was 8-9 percent, is now around 5 percent.The Finance Minister said that the...

Read More

Finance Minister positive to open share market

Kathmandu. Finance Minister Dr. to open the share market. Yuvaraj Khatiwada has been positive. Addressing the annual program of the Nepal Securities Board, Finance Minister Khatiwada said that the share market should not be held hostage for a long time.He...

Read More

Monetary policy will address stock market problems: Governor

Governor of Nepal Rastra Bank Maha Prasad Adhikari has said that the upcoming monetary policy will address the problems of the capital market.Addressing the Nepal Securities Board's annual festival program online, the official pointed out the need to use modern...

Read More

NEPSE down 200 points after the lock- down, but if you can hold, it will boom

The stock market has been closed for about three months now. The market, which had been open for two days in the middle of the lock-down, was closed again due to pressure from investors.Investors are frustrated by the corona virus....

Read More

Bank's employees at risk of corona, how to be safe

Kathmandu. The bank branches are in operation during the lock-down. Initially, the bank counties were not crowded. But after the second week of May, the crowds at the bank's branch counties have started to increase. Banks have been overcrowded this year as the private industry...

Read More

The stock market will closed Jestha month, Investors are disappointed with the budget

The government has decided to lock-down up till June 12. Along with this, the stock market will also be closed. There was an attempt to keep the market running since April 12 even in the midst of lock-down. However, investors lost more than Rs 63...

Read More

Rs. 1474.64 billion Budget announced for the fiscal year 2077/078

Finance Minister Dr. Yubaraj Khatiwada has announced the budget of Rs. 1474.64 billion for the fiscal year 2077/078.Of this, Rs. 948.94 billion has been allocated for current expenditure, Rs. 352 billion for capital expenditure and Rs. 172 billion...

Read More

32 trillion investment of banks and finance at risk - Experts

Effect of Corona Covid-19Banks and financial sector investments are at risk due to the corona virus (Covid-19). Investments by banks and the financial sector to be at risk as uncertainty grows about when will the corona virus ended.

Read More

The current economic growth rate will be 2.3 percent only

Kathmandu. The economic growth rate will fall to 2.3 percent this fiscal year. Yuvaraj Khatiwada has told. Announcing the Economic Survey Report 076 and 77 in the Federal Parliament, the Finance Minister has estimated that the economic growth rate will shrink to 2.3 percent in...

Read More

The current economic growth rate will be 2.3 percent only

Kathmandu. The economic growth rate will fall to 2.3 percent this fiscal year. Yuvaraj Khatiwada has told. Announcing the Economic Survey Report 076 and 77 in the Federal Parliament, the Finance Minister has estimated that the economic growth rate will shrink to 2.3 percent in...

Read More